Full-Time Equivalent (FTE)

Employee Calculator

Convert part-time and full-time employee hours into full-time equivalents

Full-time equivalent employees:

26.5

Are you an Applicable Large Employer?

No

Do you qualify for the small businesses tax credit program?

No

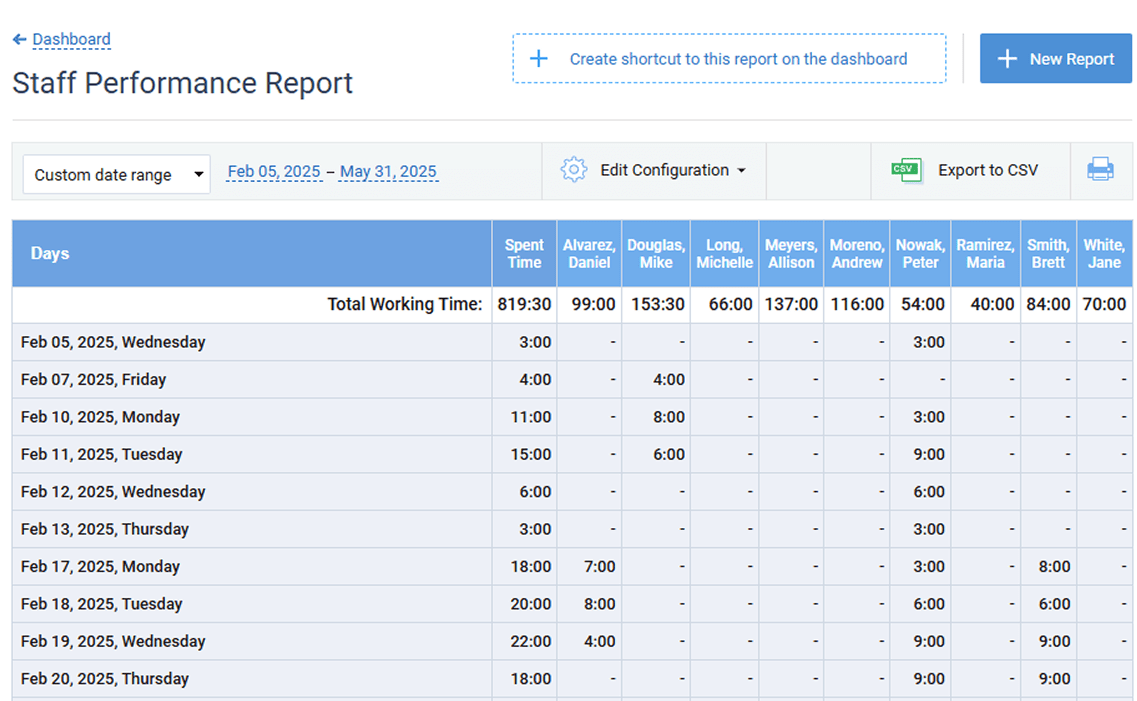

Track your employees’ work hours

with maximum precision

actiTIME makes it easy to capture real work patterns — no guesswork, no manual spreadsheets.

Try free today

FTE Basics

FTE is a way to measure the total number of work hours contributed by both full-time and part-time

employees in your organization during the year.

Calculating it is essential for analyzing your operations, benchmarking against industry standards,

budgeting, and strategic planning.

Determine eligibility for benefits

Ensure you meet minimum coverage requirements under the Affordable Care Act.

Ensure

compliance

Ascertain whether you qualify as an Applicable Large Employer (ALE).

Improve project management

Determine the number of full-time employees needed for a specific project.

Make informed hiring decisions

Ascertain whether you qualify as an Applicable Large Employer (ALE).

How to Calculate FTE Manually

Determine total hours worked:

Gather the total number of hours worked by all employees over a specific period (usually a week

or a month). This includes both full-time and part-time employees.

For example, if you have 5 full-time employees working 40 hours each per week and 3 part-time

employees working 20 hours each per week, the calculation will look like this:

5 × 40 = 200 hours

3 × 20 = 60 hours

Total hours worked: 200 + 60 = 260 hours

Define full-time hours:

Determine what constitutes full-time work for your organization. Typically, this is 40 hours per

week, but it can vary.

Divide the total hours worked by the number of hours representing full-time work:

FTE = Total Hours Worked / Full-Time Hours

FTE = 260 / 40 = 6.5

FTE Calculation Tips

Calculating FTEs accurately is all about knowing who to include and exclude in your calculations and

considering real-world factors that affect work hours.

Always include all full-time employees in your group. If your business is affiliated with another

employer, operates under common ownership, or is part of a controlled group, all full-time employees

from these entities should be counted.

If your business operates in multiple states, include employees from other states under the same

common group, even if you’re enrolling in separate state Small Business Health Options Program

(SHOP) marketplaces.

Exclude the owners of a sole proprietorship, partners, or shareholders owning more than 2% of an S

corporation, and the owners of more than 5% of other businesses should also be excluded.

Exclude the seasonal workers who work 120 days or less in a year, independent contractors, and

individuals enrolled in COBRA or retired.

Include only those part-time employees who work an average of less than 30 hours per week.

Employees do not usually work a full 52 weeks per year due to various factors. So, your company’s

actual FTE hours might be 300-400 hours less than the theoretical maximum of 2,080 hours.