In 1997 on a radio address Bill Clinton offered to “pass a flex time law that allows employees to take their overtime pay in money or in time off, depending on what’s better for their family.”

As this haven’t happened yet, all nonexempt employees working more than 40 hours a week must get one and one-half times their regular pay for those extra hours worked (at least the FLSA requires so).

Sounds simple enough, right? If you normally make $20 an hour, your overtime rate would be $30 an hour.

But here’s where the trouble starts. Many businesses fail to accurately calculate overtime, due to misclassifying employees, inaccurate record-keeping, or confusing pay structures. As a result, they face costly penalties and, worse, very unhappy employees.

In this article, we highlight common mistakes employers make in calculating overtime and offer practical solutions to help you stay both fair and compliant.

Calculating Overtime Pay

Okay, let’s get to the calculations. Here’s a look through the employee’s eyes:

- Find your employee’s regular hourly rate. This is what you earn for your standard hours. If you’re salaried, you’ll need to convert that to an hourly rate by dividing your annual salary by the number of hours you typically work in a year (usually 2080 for full-time).

- Keep a log of your hours worked each week. This includes regular hours and any overtime hours.

- Count how many hours you worked over 40 in a week. Let’s say you worked 50 hours one week. That means you have 10 hours of overtime.

- Take your regular hourly rate and multiply it by 1.5 to find your overtime rate. Then multiply that overtime rate by the number of overtime hours worked.

- Add your regular pay and your overtime pay together to get your total earnings for the week.

For example:

- Regular hourly rate: $20

- Overtime rate: $20 x 1.5 = $30

- Overtime hours: 10

- Overtime pay: $30 x 10 = $300

If you have more than one hourly rate, the scenario gets more complicated:

Let’s say you do different jobs for the same employer at different rates. You work 20 hours for $20 per hour and 30 hours at $30 per hour. Then your regular pay rate for that week will be the average of the two, with overtime calculated as follows:

- $20 x 20 hours + $30 x 30 hours = $1300

- $1300 / 50 hours = $26

- $26 x 1.5 (overtime rate) x 10 hours (overtime) = $390

- $1300 + $390 = $1690 (total)

If you have daily rate, work 5 days a week and get $100 per day with 50 hours worked in one week. To calculate their regular rate, you’ll need to take the total of your weekly earnings and divide it by the number of hours you worked.

The overtime pay will be calculated as follows:

- $100 x 5 = $500

- $500 / 50 hours = $10 (regular rate)

- $10 x 1.5 (overtime rate) x 10 hours (overtime) = $150

- $500 + $150 = $650 (total)

Now, to the piece rate. If you get $10 per piece of product created and create 150 pieces in a 50-hour week, to find out your regular rate for that week, you’ll need to summarize the total piece rate and then divide it by the number of hours worked. The resulting overtime pay calculations will look as follows:

- 150 pieces x $10 = $1500

- $1500 / 50 hours = $30 (regular rate)

- $30 x 1.5 (overtime rate) x 10 hours (overtime) = $450

- $1500 + $450 = $1950 (total)

In case you have a fixed schedule and earn a weekly salary of $600 per a typical 40-hour workweek, to calculate your regular hourly rate, we simply need to divide the weekly salary by the normal hours of work during that week.

The overtime pay for 10 extra hours will be calculated as follows:

- $600 / 40 = $15 (regular rate)

- $15 x 1.5 (overtime rate) x 10 hours (overtime) = $225

- $600 + $225 = $825 (total)

Feeling a bit overwhelmed? Don’t worry! There’s an easier way to tackle this whole overtime calculation thing. We have a free automated calculator that can do all the math for you in just a few clicks.

Simply input your hourly rate and hours worked, and voilà! You’ll have your or your employee’s overtime pay calculated in no time.

9 Overtime Pay Calculation Pitfalls That May Take You to Court and Tips on Avoiding These

Now that we’ve got the basics down, here are a few common mistakes to watch out for.

Mistake 1. Misclassifying Employees

Probably one of the most common mistakes when dealing with overtime is improperly classifying employees as being exempt when they are supposed to be non-exempt.

Back in 2019 Sonic Drive-In restaurant chain faced a class-action lawsuit for failing to compensate underage employees for working overtime; the lawsuit accused the restaurant chain of misclassifying them as exempt from the overtime pay requirements.

Sonic settled with the lawsuit for the striking $4 million in addition to $70 000 in civil penalties.

What you should know: Exempt employees are typically salaried workers who don’t qualify for overtime pay, while non-exempt employees are hourly workers who do.

The key to the right classification is understanding the criteria that determine these “exemptions”.

To be classified as exempt, an employee must meet certain salary thresholds and perform specific job duties.

As of 2023, the minimum salary threshold for most exempt employees is $684 per week (or $35,568 annually). But just paying someone over that amount doesn’t automatically make them exempt. You also need to consider their job duties.

Exempt employees typically fall into categories like executive, administrative, professional, outside sales, or certain computer-related roles.

So, you need to review the specific duties and responsibilities of each position to ensure they align with the exemption criteria.

Mistake 2. Failure to Include All Types of Compensation

Many employers mistakenly think that only base salaries or hourly wages count when calculating overtime. But there may be other types of compensation that should be included.

These include bonuses, commissions, shift differentials, and other perks like on-call pay, hazard pay, or even certain types of allowances.

What you should know: In September 2015, 174 current and former firefighters initiated a lawsuit against the City of New Haven, seeking compensation, including back pay, liquidated damages, interest, and attorney’s fees.

The lynchpin of the firefighters’ claims is that, in calculating the firefighters’ regular rate of pay (used lately to calculate overtime pay), the City failed to incorporate additional compensation that the City provides to firefighters, including, but not limited to, certification pay, education incentive pay, acting pay, hazmat pay and longevity pay.

This lawsuit highlights how important it is for organizations to Familiarize themselves with the Fair Labor Standards Act (FLSA) and their obligations as employers regarding overtime pay.

To prevent such errors, many organizations use compensation management software such as Compport to automatically track all forms of compensation, ensuring nothing is overlooked and compliance is maintained.

If you notice discrepancies in the sums you calculate, consider consulting with an employment attorney who can guide you through the process.

Mistake 3. Failure to Observe Overtime Laws of the Respective States

Imagine this: you’re a small business, and you’ve got employees putting in extra hours during busy seasons. You know that the Fair Labor Standards Act (FLSA) sets some basic rules about overtime pay—like the classic “time and a half” for hours worked over 40 in a week, and you’re paying your people based on your understanding of federal law.

Everything seems fine until one day, you get hit with a lawsuit or an audit because you didn’t account for your state’s specific overtime rules.

If you assume that overtime laws are the same everywhere, think again!

What you should know: Overtime laws differ significantly from state to state. For example, in California there is a different approach to calculating overtime if an employee is given a flat-sum bonus.

Moreover, the standard work week length can also vary. It is 44 hours in Canada, 40 hours in the United States (and most other countries of the world), 38 hours in the UK, and just 35 hours in France.

How do you avoid falling into this minefield? Well, here’s a number of tips that might help:

- Take some time to know about the local labor laws and minimum wage requirements, meal breaks, and stuff.

- Hire an HR consultant or a labor lawyer to help your company stay in compliance with federal and local regulations.

- Keep your managers and HR people current on overtime laws. Regular training sessions can help everyone stay on the same page.

- Audit your payroll practices for compliance. It is better to find mistakes now rather than be forced to deal with the fallout afterwards. For companies managing teams across different states or countries, staying compliant with varying overtime rules can quickly become overwhelming. Some businesses choose to work with local payroll providers or consultants in each region, which can be effective but also time-consuming and fragmented. Others use centralized platforms like AI-powered global employer of record from Borderless AI or other similar tools, which help streamline global payroll by automatically adjusting for local labor laws, overtime calculations, and tax requirements, whether you’re operating through your own legal entities, theirs, or a mix of both. This approach can reduce the risk of errors while keeping payroll operations consistent across borders.

Mistake 4: Not Keeping Accurate Track of Hours

Inaccurate timekeeping can lead to a host of problems, and miscalculated overtime pay is just one of these. Whether it’s clocking in late, forgetting to punch out, or even just rounding errors, these little discrepancies can snowball into significant financial headaches.

What you should do: Use a reliable timekeeping system that records hours worked accurately.

There’s the old-fashioned way of Excel or a calculator with a piece of paper, or – if you are serious about reducing overhead — a more modern approach that consists of adopting a specialized timekeeping solution.

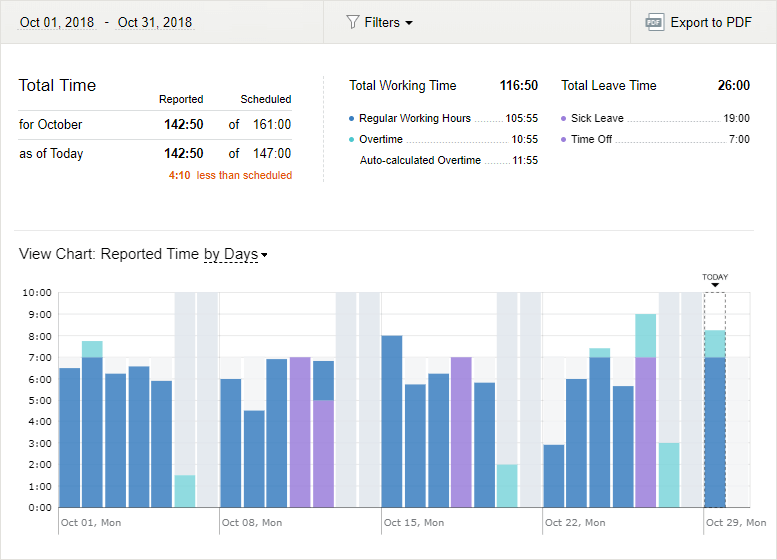

With simple timesheet software like actiTIME, you can automate overtime calculations and get instant access to current work data for each employee.

Detailed charts and reports provide a breakdown of your team’s overtime hours and associated costs for a specific period.

Check it out now – your business will run like clockwork!

Mistake 5. Forgetting to Account for Breaks and Meal Periods

Under the FLSA, “hours worked” include not only time spent productively, but also non productive periods, such as rest breaks, travel time, and training sessions.

Employers often fail to consider how breaks and meal times factor into overtime calculations.

For instance, if an employee works during his or her designated break time, those hours may need to be included in the total for overtime calculation.

What you should do: Implement specific policies about breaks and meal periods and clearly communicate them to employees.

Make sure your timekeeping systems accurately captures missed breaks and all time worked is fairly compensated.

Mistake 6. Miscalculating Overtime Rate

If you think that to determine the overtime rate you simply need to take the regular hourly rate and multiply that by 1.5, you may be very wrong.

What you should know. As said above, the sum should include one’s nondiscretionary bonuses, shift differentials, and other types of compensation to be correct.

Consider a non-exempt employee who earns $10 per hour and works 50 hours in one week, plus a $200 nondiscretionary productivity bonus. Here is how their overtime should be calculated:

Step 1: Calculate total straight-time compensation by adding the hourly wages for all hours worked plus the bonus.

($10 hourly rate x 50 hours worked) + $200 bonus = $700

Step 2: Calculate regular rate of pay by dividing total straight-time compensation by total hours worked.

$700 total compensation ÷ 50 hours worked = $14 regular rate of pay

Step 3: The overtime pay is calculated using the regular rate times 0.5 times the number of overtime hours.

$14 regular rate x.5 x 10 overtime hours = $70

Because the straight-time pay was already calculated in Step 1, the employee would receive an additional $70 based on 10 hours of overtime. If the employer had excluded the bonus from the regular rate calculation, the employee would have been shorted $10.

Step 4: Calculate total compensation.

$70 overtime pay + $700 straight-time pay = $770 total compensation

Mistake 7. Failing to Pay Overtime for Unauthorized Work

The FLSA requires to pay non-exempt employees for all hours worked, including overtime, whether or not pre-approved by management.

What you should know: You cannot deny overtime pay if the overtime was worked. Even if as an employer you have rules requiring overtime to be preapproved, you may only discipline employees for working unauthorized overtime.

Mistake 8. Offering Compensatory Time Off Instead of Overtime Pay

Employers in the private sector can’t provide compensatory time – time off instead of paying overtime, it’s just illegal.

Mistake 9. Using the Fluctuating Workweek Method Incorrectly

To use the fluctuating workweek method of calculating overtime under the FLSA you should ensure that:

- The employee’s hours must fluctuate from week to week;

- The employee receives a fixed salary for whatever hours they are called upon to work in workweek, regardless of how few or how many;

- There’s a documented agreement between you and the employee that the fixed salary is a compensation (apart from overtime premiums) for the hours worked each workweek;

- The salary is sufficient to provide compensation to the employee for each hour worked in the workweeks in which the number of hours worked is greatest at the applicable minimum wage; and

- The employee must receive overtime pay no less than one-half times their regular rate for all hours worked over the prerequisite.

What you should know: An employee’s regular rate is determined by dividing the amount of a given week’s salary by the number of hours they worked during that week.

Let’s say an employee gets $700 a week. They are told that the salary is for all hours worked in the workweek and there may not be any overtime, bonus or other incentive pay added. The employee never works more than 50 hours in any given week.

The employee works 37.5 hours during week one and 48-hours during week two. During weeks one and two, the employee works for night shift hours per week, which are compensated at the premium rate of $10 per hour.

$700 (Fixed salary) + $40 (4-night shift hours x $10 premium pay) = $740

Now, let’s calculate the regular rate:

Week 1: $740/37.5 hours = $19.73 per hour

Week 2: $740/48 hours = $15.42 per hour

Total compensation: $700 (salary) + $40 (4 night-shift hours x $10 in premium pay) = $740

Compensation + overtime: 8 hours of overtime x ($19.73 regular rate of pay x.5) = $76.92

Now, add overtime pay to straight-time earnings (for this example, $700 salary plus $40 night-shift pay) to calculate total pay.

$740 straight-time earnings + $76.92 overtime pay = $816.92

Conclusion

Calculating overtime isn’t overly complicated, but it’s important to pay attention to the details like employee eligibility, work schedules, pay rates, and ever-changing laws. There’s a lot to consider ensuring your calculations are accurate.

Using an automated calculator or a reliable timekeeping system can make a big difference. Why not give it a try? Sign up for a free actiTIME trial today and enjoy peace of mind knowing your overtime calculations will always be spot on!

![9 Best Contractor Time Tracking Apps for 2026 [Free & Paid]](https://www.actitime.com/wp-content/uploads/2020/10/how-to-find-efficient-contractor.png)