Cost is a critical factor of success in project management and, undoubtedly, the most essential parameter to consider when initiating a new project.

Inadequate expense control increases the risk of running out of funds too quickly, which can eventually compromise your ability to complete the project on time, if at all. For this reason, the creation of an accurate project budget contributes to both the effectiveness of cost management and the entire project’s outcomes.

Here we will explain why budgeting is so important for those who aspire to achieve outstanding financial and productivity outcomes. Besides, to help you start with the making of your own budget, we have prepared a free project budget template that may be downloaded at the end of the page.

What Is Project Budget?

A project budget is the sum of costs and revenues associated with a particular business endeavor and all the elements required to drive it toward successful completion.

These elements can be divided into two major groups:

- Resources, including personnel, technology, knowledge, and other hard and soft assets, depending on specific project characteristics and aims.

- Activities, including supply, production, sale, delivery, and other actions and operations that necessitate investment and are meant to serve ultimate project goals.

How to Make a Perfect Project Budget

Step 1: Define your project scope

A clear work scope breaks down each element of the project, outlining what needs to be done, when, and how, so you can allocate resources precisely and avoid any nasty surprises.

To nail down that scope:

- Start by sitting with your team and brainstorming the goals of your project. What are you actually trying to achieve?

- Once you’ve got the big picture, dive into the specifics – list out every task, big or small.

- Talk to stakeholders to make sure everyone’s on the same page and that you haven’t missed anything.

- Prioritize tasks, so you know what’s essential and what might actually be wishful thinking.

- Sketch out a timeline – understanding which tasks depend on others is key here.

Learn more about creating a detailed work scope in this post.

Step 2: Research and estimate costs

Researching and estimating costs upfront means you’re not blindsided by unexpected expenses. This proactive step keeps the project on track and within financial limits, paving the way for success without the stress.

So, how exactly do you ace this process?

- Begin with the obvious – list everything you think you’ll need. Supplies, labor, equipment – you name it.

- Research each item on your list thoroughly. Use past projects for guidance or tap into online databases and suppliers for current pricing. This gives you a solid foundation to work on.

- Reach out to colleagues or professionals who’ve completed similar projects. They can offer insights you might not find googling around.

- Projects often have a mind of their own. Set aside a contingency fund (say, 10-20% of your total estimated budget). It gives you a cushion without derailing finances.

- Keep refining the budget as you gather more data to ensure it’s both realistic and robust. Flexibility is key.

Choose the best cost estimation technique here.

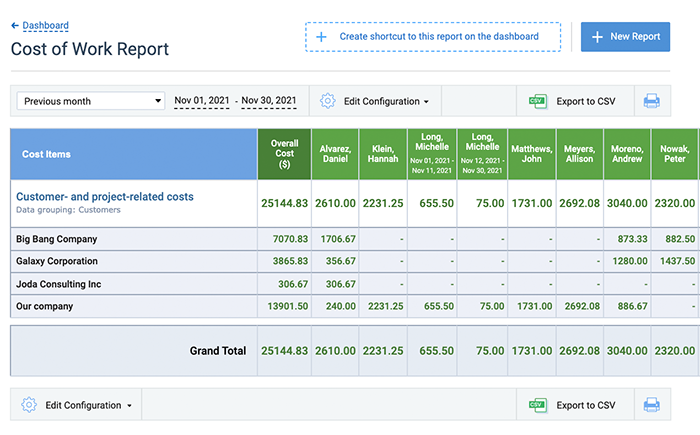

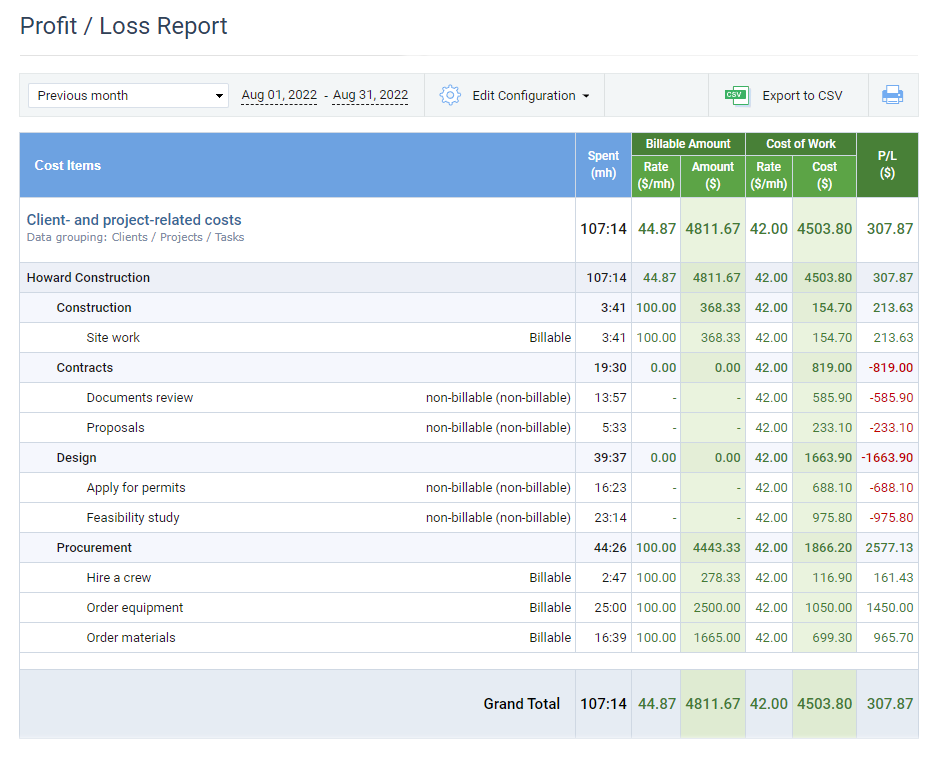

Leverage historical project data in actiTIME reports to inform your cost analysis process and get more accurate estimates.

Step 3: Assign cost estimates to each task

By analyzing expenses at the task level, you gain transparency and can allocate funds more strategically, making it easier to track progress and control costs.

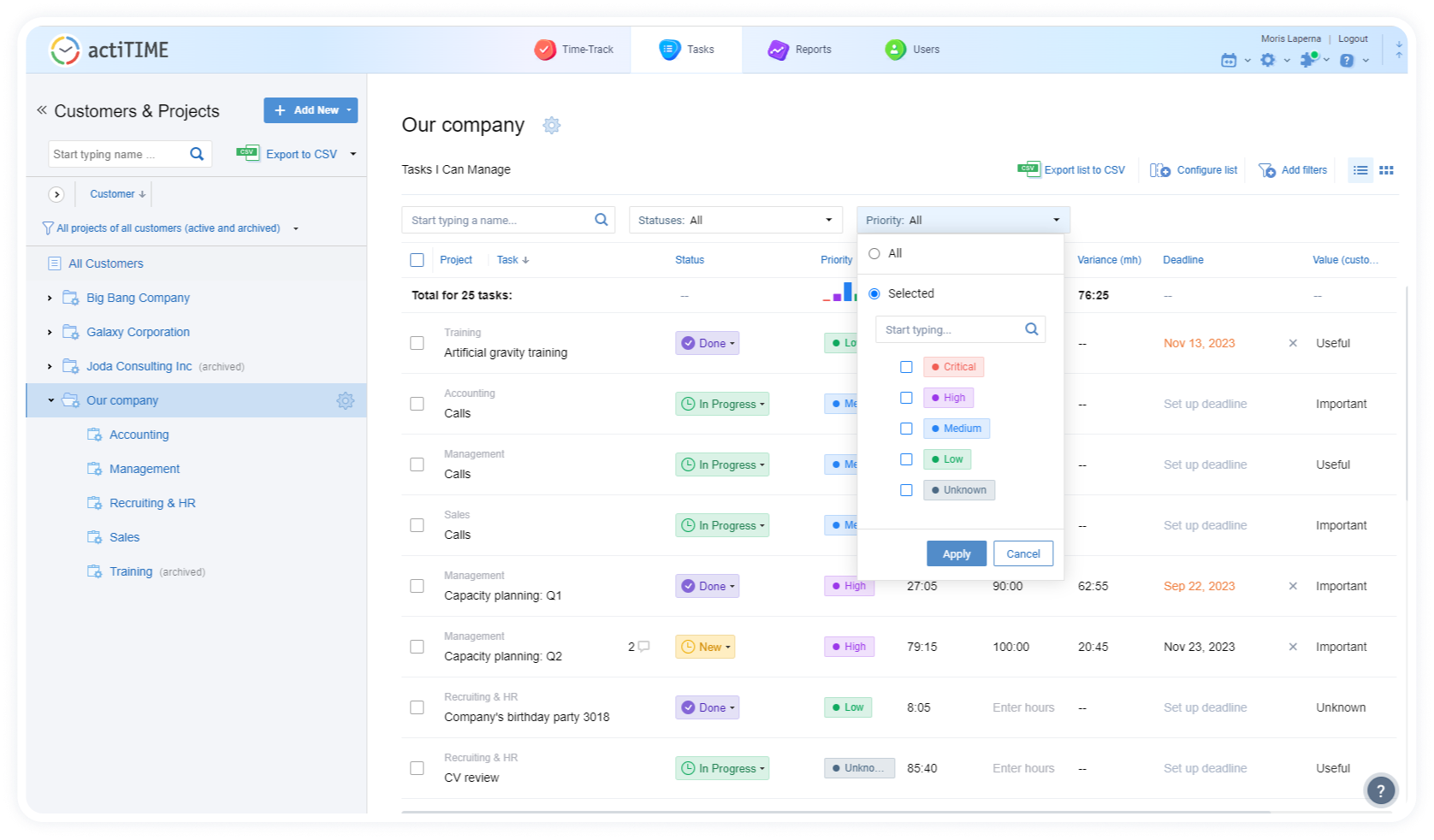

To break down your entire project budget into smaller chunks, use actiTIME. This multifunctional project tracking solution allows you to allocate budgets at three different levels: entire customers, entire projects, and individual tasks.

Besides cost budgets, you can create time and billing budgets for your tasks to stay in control of a greater range of project resources:

- Simply choose a project or task from the list,

- Open the Budgets tab,

- Pick the type of budget you want to create,

- Enter the budget amount,

- And set the timeframe.

That’s it!

From now on, actiTIME will calculate your budget use automatically, making it easier to keep up with the ongoing progress and monitor risks.

Explore actiTIME’s budget tracking features firsthand – sign up for a free 30-day trial here.

Step 4: Track spending

Keeping tabs on every penny is crucial. It ensures resources are utilized wisely and helps prevent nasty surprises down the line.

To keep your spending tracking process truly accurate, use an automated tool like actiTIME. Its budget tracking functionality is all about foresight and clarity. It offers a visual progress bar for each of the allocated budgets so you can effortlessly identify when you’re nearing the brink of an overrun.

As you cruise through your project, the progress bar keeps you informed, stepping in with a gentle yet firm alert by turning red when excesses loom.

Use actiTIME to allocate budgets to entire projects or individual tasks and track them visually in real time.

Step 5: Learn and improve

Effective project budgeting requires patience, skill, and most importantly, lessons from previous experiences. These past experiences are crucial because they serve as a treasure trove of insights and lessons that can prevent past mistakes from repeating themselves.

Here’s how you can learn from them:

- Pull up budgets from previous projects and take a moment to really scrutinize them. What went well? What didn’t? Look for patterns or recurring issues. Maybe you consistently underestimated the cost of materials or overlooked travel expenses. These insights can illuminate blind spots that need closer attention this time around.

- Based on your reflections, jot down any lessons learned. Think of this as your cheat sheet, something you’ll refer back to as you assemble your new budget. Document why particular aspects of past budgets failed or succeeded – this will give your current budget a robust framework rooted in reality.

- Two heads are better than one, and your team may have insights that slipped under your radar. Gather input from team members who played a role in previous projects. They might offer practical advice or recall scenarios that your individual analysis missed, thus fortifying your budget even further.

- Now that you have your list of dos and don’ts, apply them to your current project. If you found that your past logistics estimates were off, account for that in your new projections. Adjust timelines and buffer amounts, and have contingency plans ready. Remember, being flexible yet precise is key.

Use actiTIME reports to learn from your previous experience and step up your project budgeting game.

Benefits of Excellent Budgeting

1. Budgets provide economic justification for projects

When thinking up a new project, it is easy to overestimate your abilities, especially if you commence it in an unfamiliar field or plan to engage in an endeavor to which you have a strong (and irrational) emotional attachment.

By identifying, categorizing, and figuring out project costs, a budget lets you see whether your business idea is worth proceeding with in terms of money. When making the budget, you may discover many types of costs – both direct and indirect – that you weren’t even aware of previously. Besides, by evaluating the profitability potentials of the intended business operations, you can determine if your project will actually bring any income.

2. Project budgets help define tactics

Your budget supports the making of higher-quality decisions not only regarding the way to spend the investment sum but also about the execution of project-specific tasks.

A detailed overview of possible expenses will help you set the right priorities, which is particularly important in the context of financial constraints.

With a well-prepared budget, you can see whether some of the planned project activities are too financially intensive and then choose to substitute them with cheaper alternatives. In case an expensive activity or resource is essential and cannot be discarded, your budget forecast will help you locate a few of the less significant but costly ones and set them aside instead.

3. Budgeting establishes the basis for spending control

Once you are sure that the project deserves your efforts and that the means selected to attain the primary project goal are financially reasonable and appropriate, it is time for action. When the work on the project starts, the budget will serve as the foundation to control spending.

With a good budget plan, cost monitoring becomes as easy as ever. Numbers identified during cost and income estimation will set the spending limits explicitly, so you and your team members won’t have to second-guess whether the project can afford another piece of expensive hi-tech equipment or that high-priced marketing campaign – the budget will provide a rationale for every spending decision.

Outcomes of Poor Budgeting

Poor budgeting can harm your business in two major ways:

- By causing tangible financial loss,

- And by having an adverse impact on such intangible business assets as reputation and customer trust.

1. Financial loss due to deficient cost control

While a well-developed budget helps you see whether the planned project activities meet your current financial capacities, with an inadequately performed budgeting, you are bound to make financial decisions based on assumptions and intuition alone.

As such, intuitive spending may not be a tremendous problem if you are highly independent as a worker and initiate a very small project that is easy to supervise. However, when multiple stakeholders and extremely diverse and numerous operations are involved in project realization, the lack of a holistic financial view is detrimental. Blind spending in large projects may negatively affect your ability to:

- Detect declines in funds in a timely manner,

- Predict the project’s risk tolerance,

- And select the right way to allocate resources.

Thus, without proper budgeting, you will bear an elevated risk of cost overruns and financial insolvency that will threaten the well-being of the project as a whole.

2. Damaged stakeholder relationships and reputation

As the project starts to lose money due to poor monitoring of spending, your ability to deliver on the desired business outcomes, including quality and customer satisfaction, will likely diminish correspondingly.

It can be quite painful to lose money and witness your endeavor collapse – you will surely need some time to recover from such an occasion. However, the negative experience and adverse consequences can increase multifold in case your project implies cooperation with many individuals and businesses (e.g., you specialize in the provision of educational services or the supply of raw materials to manufacturing companies). In this situation, your failure may cause a lot of trouble to stakeholders and, unfortunately, once you’ve become a source of major disappointment and loss for others, it takes an enormous amount of work to regain their trust.

Definitely, an accurate project budget plan cannot be the only salvation from reputation damage. Nevertheless, its creation will become a good beginning in the prevention of such a risk.

Basic Rules of Successful Budgeting

Now that you know why a well-developed budget is crucial, you’re probably wondering what is required to make it. The following brief list will give you a general understanding of things to consider throughout the budgeting process:

- The budget should be aligned with the project’s short-term objectives and long-term goals. In this way, you will ensure that the spending is meaningful and the allocation of resources is optimal.

- The budget shouldn’t rely only on intuition, as well as past activities and records. While previously collected data is important to take into account during the budgeting process, to be realistic, the budget should be future-oriented and based on original analysis of current external and internal factors.

- The budget must be made by using the right methods and techniques. With a more thorough and rigorous calculation of expenses, the accuracy of budget forecasts increases.

Keep these determinants of successful budgeting in mind when creating the project budget, and don’t forget to check out our free project budget template, which was designed to give you space and structure for estimating the expenses of your new projects.

Use this template to work out costs in an easy-to-read format and customize it by adding or deleting items in order to suit the specifics of your business.

Conclusion

All in all, budget management is an integral component of a comprehensive and highly strategic methodology with the purpose to verify that:

- The project has realistic goals,

- Its demands are feasible to satisfy,

- The team has sufficient resources at their disposal,

- And the work on project-related tasks will go on smoothly till the end of the deadline.

Besides, budget tracking helps to prevent overspending and ensures the efficient use of resources.

To organize your project budgeting process and and monitor project expenses with greater efficiency, consider using actiTIME. With its help, you will reduce the risk of cost overruns and financial failure while increasing profitability and quality of performance.

If these things are what you’re aspiring to, sign up for a free actiTIME trial now!

![9 Best Contractor Time Tracking Apps for 2026 [Free & Paid]](https://www.actitime.com/wp-content/uploads/2020/10/how-to-find-efficient-contractor.png)