Existing overtime regulations are severely outdated. The salary threshold of $23,660 per year has been battered by inflation over the years. As a result, millions of Americans are deprived of overtime pay. It’s been quite a while now that the U.S. administration became aware of this.

Now finally the Government announced that new overtime rules are ready to roll. They will go into effect on December 1, 2016. Let’s see how this will play out for businesses and workers.

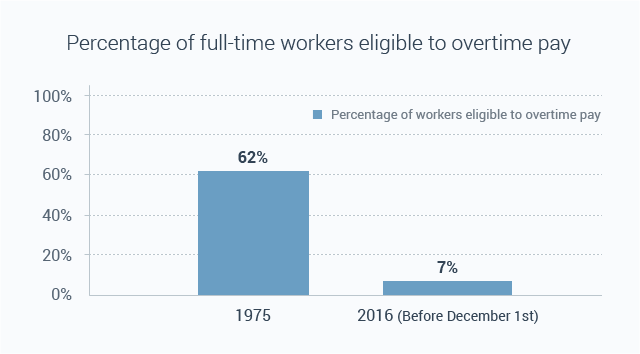

Source: The White House factsheet

What is Overtime?

Typically, overtime refers to any hours worked above normal working hours in the week. It doesn’t apply to hours worked on Sundays or holidays, if it is not the basic schedule of an employee.

The standard workweek in the U.S. lasts 40 hours. However, nearly one fifth of Americans are working between 50 and 59 hours on average, according to the Gallup poll of 2014. Are they getting any extra pay? If they are white collar workers with managerial duties, most likely, no.

Changes to Federal Overtime Rules

So what do current overtime regulations say? They state that workers don’t qualify for overtime pay if:

- They receive a fixed salary of at least $455 per week (equal to $23,660 per year).

- They perform executive, administrative, or professional duties (so-called EAP workers), or work in outside sales or computer field.

Generally, both conditions must be met for the employee to be excluded from overtime pay. If a worker is paid on a “fee basis“, it should be checked whether the fee satisfies the minimum salary requirement. Say, a designer completes a project in 20 hours and gets paid $250 for this job. Had he worked 40 hours a week, his salary would equal to $500 per week, so the person would be exempt from the overtime pay.

The final rule is aimed at raising the salary thresholds, so that they stay up-to-date with the current wages. Here are the proposed changes for new overtime pay qualification:

- The standard salary level should be no less than $913 per week (or $47,476 annually).

- The salary threshold for highly compensated employees should be raised to $134,004 annually.

- Every three years these levels will be automatically indexed to account for inflation.

Outcome for Workers

Apparently, regular workers should be in a “win-win” situation when the new rules come into force. Either they receive a pay for extra hours, or can go home after 8 hours at work, so that they get more time for their family, leisure or personal care.

What can be seen as a disadvantage here, is that some employees don’t want their overtime hours to be forcefully cut back. No, it’s not a joke. Many startup employees are ready to work hard with little reward, expecting a big payout in the future. As Adam Robinson, head of IT company Hierology, put it, new overtime regulations are likely to disrupt startup technology sector as such.

Outcome for Businesses

As for the companies, they are facing a tough challenge. No matter how they decide to act, the new regulations will boost their costs. And there aren’t any exceptions for startups or small businesses who are at risk of becoming casualties of this reform.

To comply with the new rules, businesses can choose one of the paths to go:

- Pay overtime bonus at 1.5 rate of the standard salary.

- Cap working hours to a maximum of 40 per week, and hire part-time workers to balance the workload.

- Raise salaries to put them above the new weekly threshold of $913, so that the employees will get the exempt status.

- Move staff from salaried positions to hourly employees or “independent contractors” (so-called 1099ers).

The latter approach is the least attractive for the employees, since they would lose their benefits and stable salary. For employers, things are not that obvious. To decide which model works best for them, they would need a tool to analyze their salary and overtime costs.

How Employers Can Prepare for the New Overtime Pay Model

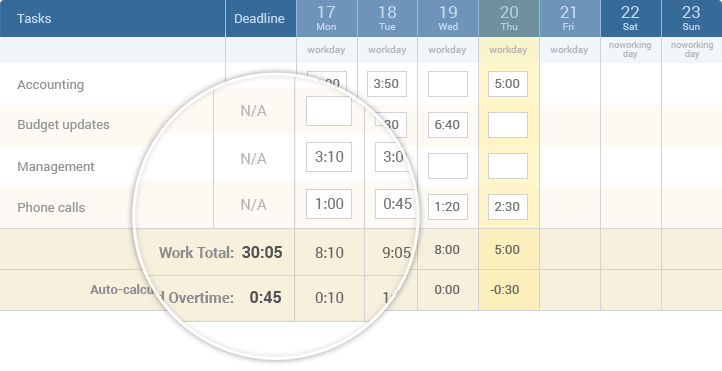

Timekeeping applications will provide insight into companies’ workloads and resources and show how overtime is calculated. Many companies may already have overtime tracking software in place. Those who don’t would need to get a system to keep an account of employees’ working hours. Besides, automatic overtime tracking will help reduce red tape.

To get a full picture, you can collect time-tracking data for one month and then analyze the figures. For instance, this online timesheet allows you to track regular and overtime hours and create granular reports on collected data. These reports will show you what you would need to pay, were the new rules to come into effect today. You can benefit from this functionality by signing up for a free 30-day trial which has a built-in overtime tracking feature.

Summary

The proposed changes to overtime rules have long been in the pipeline. They have a noble goal: to ensure that everyone is fairly paid for hard work. To comply with the rules, businesses will have to react and make necessary adjustments. But with some analysis and preparatory work, they will be able to choose the best way to go.

P.S.

In fact, this blog article has been completed in overtime hours. All time spent on it was recorded in actiTIME online timesheet to ensure that the author of the article and blog designers get a fair pay for their hard work. Time is worth tracking.

![9 Best Contractor Time Tracking Apps for 2026 [Free & Paid]](https://www.actitime.com/wp-content/uploads/2020/10/how-to-find-efficient-contractor.png)