With all the remote work and flexitime trends, most employees no longer work eight hours sharp every working day. More than that, the gig culture is rising and many companies work with freelancers, half-time and hourly workers, which poses a question of how to calculate payroll hours for all these types of workers.

Another factor that complicates time tracking and payroll calculations is the abundance of time tracking tools and methods. Some companies still use paper timesheets, others log hours into Excel sheets, some companies require employees to punch time cards – all these approaches require a lot of manual calculations and great attention to detail. How to calculate payroll hours and stay sane – learn from our article.

How to Calculate Payroll Hours

The following steps can be applied to any time tracking method. Depending on the method used in your company, some steps can be redundant, so you can skip to the next ones.

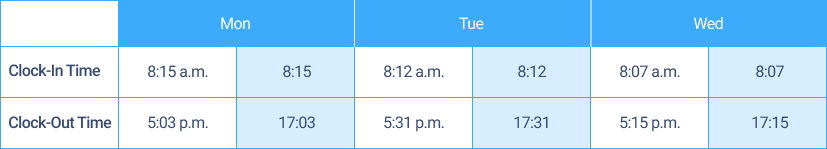

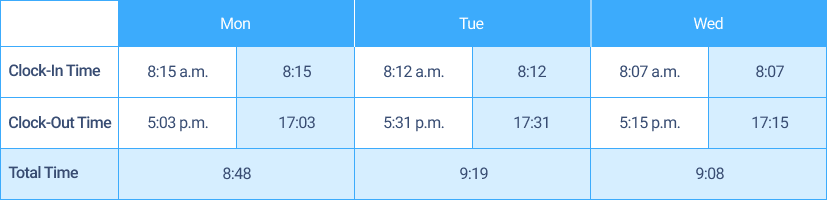

Step 1. Convert start and end-time hours to the 24-hour format: add 12 to the afternoon hours.

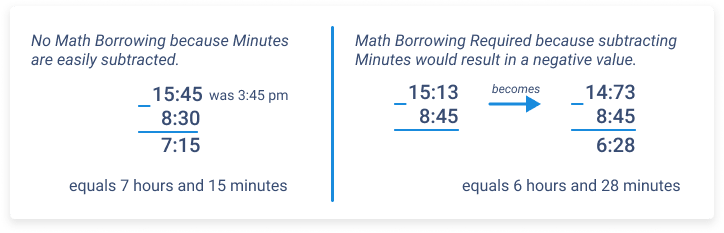

Step 2. Calculate the total number of hours worked for the day. Subtract the start hour from the end hour.

If end-hour minutes are greater than start-hour minutes and they don’t subtract easily, borrow 1 hour, i.e. 60 minutes, from the end hours.

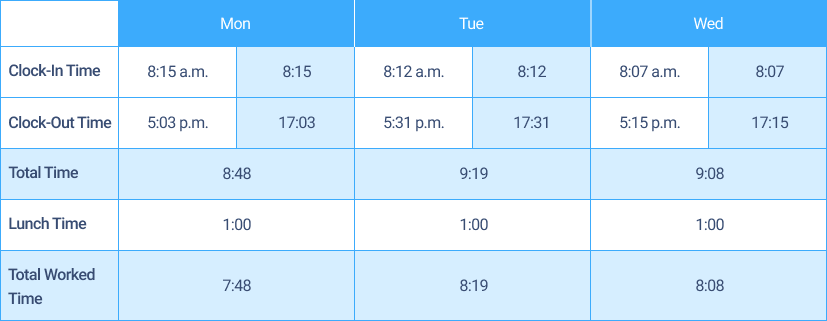

Step 3. Subtract unpaid hours, if any. Reduce these total hours by unpaid lunch or break times.

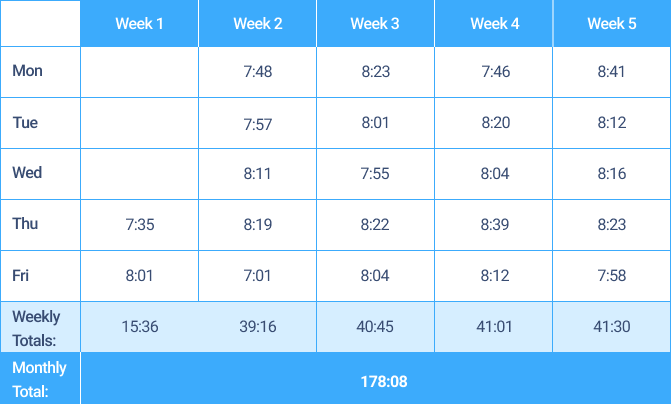

Step 4. Calculate total worked hours for the month. Add all worked hours for the past month to get the total number of worked hours for the month.

Step 5. Calculate the minimum number of working hours for the month. Multiply the number of working days in the month by the number of working hours per a working day.

Step 6. Calculate overtime hours, if any: subtract total worked hours from the month’s minimum number of working hours.

Now you can use these working hours and overtime amounts to calculate payrolls according to your state and company policy.

How to Calculate Payroll Hours Automatically

Excel sheets, paper timesheets, time cards are outdated methods for tracking time. Not only are they unreliable, they are also not accurate and require time to do all the calculations manually. Instead, most companies nowadays use time tracking systems that automate all the calculations and provide additional features such as task management and payroll calculation.

For example, in actiTIME, you can track time via online timesheet, browser extension or mobile app. All time entries will be displayed in the weekly timesheets according to the day and the task. If you define the maximum number of working hours per day, the system will automatically calculate the overtime amounts for you.

Online timesheet interface in actiTIME where every user can select task parameters

they want to see in their timesheets

More than that, in actiTIME, you can define individual hourly and overtime rates, allowing the system to calculate the payrolls for you. Set rules for calculating absences, create custom schedules, ask employees to comment on their entries – fine-tune even the tiniest details to allow actiTIME do all the work for you.

Reports dashboard in actiTIME – set up real-time data widgets

and add report shortcuts for quick access

If you hesitate about whether actiTIME is the right fit for your needs, explore the full functionality with our free 30-day trial (no credit card required) or book a demo with one of our product experts.