Estimation is one of the 4 core components of project cost management and an integral part of the budgeting process. The importance of project cost estimation is hard to overrate – without adequate estimates, it’s impossible to allocate and utilize funds properly and ensure that the team won’t experience cost overruns at some point throughout the course of project realization. Overall, estimation is a significant prerequisite for a project’s long-term financial health, and it is essential to invest enough effort in performing this practice the right way.

But what are the best project cost estimation techniques? Unfortunately, there’s no single answer to that question. The purposes of different estimation techniques are not necessarily the same, and one must choose a method while considering how mature their project plan is.

This article will help you get a more in-depth insight into the matter of cost estimation and select the optimal means for cost calculation. Here, we’ve reviewed 10 project cost estimation techniques and described their strengths and weaknesses. Besides, on this page, you will learn about the levels of estimates’ accuracy and the factors of their credibility.

With all this knowledge, you’ll get one step closer to your project’s success.

- Cost Estimation Is…

- Why Do You Need Accurate Cost Estimates?

- Types of Costs You Can Estimate While Planning a Project

- Estimate Credibility Factors

- Classes of Cost Estimates (It’s All About Accuracy)

- 10 Essential Project Cost Estimation Techniques

- How to Make Sure Your Cost Estimates Are Accurate: Tips & Tricks

- Conclusion

Cost Estimation Is…

Project cost estimation is pretty much what it sounds like – figuring out how much cash you’re gonna need to make your project a reality. It’s all about predicting the cost for all the resources you’ll use, whether that’s materials, tools, people, or even snacks for the team meetings. It’s a crucial step because no one likes surprises when it comes to money, especially in the middle of making something cool happen.

Why Do You Need Accurate Cost Estimates?

- Budget allocation: Accurate cost estimates allow managers to allocate the budget effectively, ensuring that resources are directed to where they are most needed and preventing overspending or underinvestment in key areas.

- Project feasibility: By understanding the actual costs, managers can assess the feasibility of projects. This helps in deciding whether the potential benefits justify the expense and aids in making informed go/no-go decisions.

- Risk management: It helps managers identify financial risks by highlighting areas with significant cost uncertainties. This foresight enables the development of mitigation strategies to manage potential overruns.

- Stakeholder confidence: Reliable cost estimates build trust with stakeholders, as they demonstrate a thorough understanding of project requirements and the ability to manage finances responsibly.

- Profitability analysis: As part of strategic planning, cost estimation is critical for determining the profitability of different projects or products, guiding managers toward more profitable ventures.

- Resource planning: By anticipating costs, managers can plan for the necessary resources throughout the project’s lifecycle, ensuring that personnel, equipment, and materials are available when needed.

Types of Costs You Can Estimate While Planning a Project

- Direct costs: Costs that are directly attributable to the project, such as labor, materials, and equipment.

- Indirect costs: Costs not directly linked to project deliverables but necessary for the overall operation, like utilities, rent, and administrative expenses.

- Fixed costs: Expenses that do not change over time, regardless of the project’s production levels or scale, including salaries and lease payments.

- Variable costs: Expenses that fluctuate with project activity, such as raw material costs and hourly wages.

- Operational costs: Ongoing costs to run a product, system, or service post-project completion.

- Capital costs: One-time expenses for the purchase of assets, land, or technology that may have a benefit over multiple projects.

- Labor costs: Payment for human resources working on the project, encompassing wages, benefits, and taxes.

- Overhead costs: General business expenses that are spread across projects, like corporate staff salaries or marketing expenses.

- Opportunity costs: The potential benefits surrendered when choosing one project over another.

- Sunk costs: Costs that have been incurred and cannot be recovered.

- Contingency costs: Funds set aside to address unforeseen events or risks during the project.

- Legal and regulatory costs: Expenses associated with compliance with laws and regulations, such as permits and licenses.

Gain insights into project budgeting and cost management with our free guide. 👇

Estimate Credibility Factors

To fulfill its function and be of any value, a cost estimate should be reasonable and trustworthy. Yet how to guarantee that your calculation results are sufficiently credible? The U.S. Department of Energy recommends managers to abide by these 8 rules:

- Form a clear picture of the project’s constraints, characteristics, conditions, and tasks to have a realistic view of its financial requirements;

- Involve employees from different organizational levels in the estimation process to ensure information applied during decision-making is complete and reliable;

- Utilize relevant and high-quality data when estimating costs;

- Implement a standardized and structured approach to estimation;

- Take into account risks, uncertainties, and possible environmental changes, such as cost escalation due to inflation;

- Recognize excluded costs and make sure you have a good reason for not including them in your project budget;

- Conduct an independent review of final estimates to verify their accuracy;

- Always update forecasts in case your project plan and design have been subject to any modifications.

If you succeed in sticking to these recommendations, your chance of creating sound and reliable estimates will increase multifold.

Classes of Cost Estimates (It’s All About Accuracy)

Cost estimates may be characterized by varying levels of accuracy, depending on calculation techniques used and phases of the project’s life cycle when the estimation process took place.

Today, one can find many systems for categorizing cost estimates in terms of their accuracy. Below, you will find the one created by the U.S. Department of Energy:

- Class 5 Estimate (lowest accuracy level) can be received during the initial phase of project planning. Its only aim is to screen and evaluate different project and cost concepts. Methods: Analogies, judgment, and parametric models.

- Class 4 Estimate (low accuracy level) can be obtained when the project plan is defined by 1-15%. Its primary function is to analyze performance feasibility. Methods: Equipment-factored or parametric models.

- Class 3 Estimate (medium accuracy level) can be developed when the project is defined by 10-40%. It serves to authorize and control budgets. Methods: Semi-detailed unit cost analysis.

- Class 2 Estimate (high accuracy level) can be obtained when the project is defined by 30-70%. It supports cost control activities and bidding. Methods: Detailed unit cost analysis.

- Class 1 Estimate (highest accuracy level) can be received when the project plan is mature by 65-100%. It helps verify cost estimates or design compelling bids. Methods: Detailed unit cost analysis.

As you can already see from the above classification, some types of project cost estimation techniques are best to utilize when the project is still in the early phase of its development. At the same time, others require extensive knowledge of project details.

To better comprehend which approach is appropriate for your situation, let’s take a closer look at 10 project cost estimation techniques.

10 Essential Project Cost Estimation Techniques

1. Expert Judgment (Class 5)

Expert judgment implies consulting with experienced cost estimators or specialists in the field of your company’s performance. When predicting costs by using this technique, you rely on experts’ knowledge of the project’s contents and the general business environment. In return, you get meaningful, evidence-based assumptions and explanations of relational patterns between relevant cost variables.

Pro: While computerized cost estimation is widely considered to be the most accurate, results obtained with the help of digital analytics tools are still not always correct. To eliminate estimation errors and make common sense of the generated numbers, human insight is often required. Therefore, expert judgment is indispensable when you need to identify intricate correlations among different cost variables and project-related factors and verify the accuracy of computer-supported calculations.

Con: Regardless of how knowledgeable and skilled humans may be, they are prone to make mistakes, whereas their judgment is frequently influenced by emotion and prejudices. For this reason, cost estimates obtained through expert review can be subject to bias.

2. Delphi Method (Class 5-3)

The Delphi method is an interactive forecasting technique carried out by a group of experts. During a series of meetings, each member of the expert panel provides their cost forecasts in the questionnaire format. The answers are then analyzed and anonymously announced to others by a facilitator. This activity is repeated for two or more rounds to provide experts with an opportunity to adjust their forecasts each time until the ultimate goal of the Delphi method – consensus on a final cost estimate – is attained.

Pro: Since the Delphi technique is performed by a collective of experts, it overcomes the disadvantage of expert judgment by reducing the risk of bias. Also, this project cost estimation technique is highly structured and implies the use of statistical analysis. Thus, it can be characterized by a relatively high level of result accuracy.

Con: Implementation of the Delphi method is a resource-intensive endeavor. It usually takes a lot of time to analyze individual answers gathered during panel meetings and reach a consensus in case experts have highly varied opinions at the beginning. In some situations, the agreement may never be reached without some significant trade-offs. Besides, there’s also always a chance to attain consensus on a wrong estimate.

3. Estimation by Analogy (Class 5)

Analogous project cost estimation is the calculation of a new project’s costs by contrasting the knowledge of its contents and features with data obtained when administering a similar project in the past. This technique involves 3 key steps:

- Determine a new project’s attributes,

- Locate any previous project with similar characteristics and retrieve all the information about its costs and financial performance,

- Develop original cost estimates based on the acquired historical data.

Pro: Estimation by analogy is relatively easy to carry out if you have experience in managing comparable projects and have kept their performance records. Moreover, since the results of your previous business endeavors are already known, you may adjust new cost estimates in a way that eliminates all the errors encountered before and leads to greater project success.

Con: Though analogous estimation may produce highly accurate forecasts, it is important to remember that data concerning past events does not always apply to the present-day business situation. Thus, to verify historical estimates and minimize the risk of errors, one needs to carry out an up-to-date environmental analysis as well.

4. Vendor Bid Analysis (Class 5-3)

If services and products required for project realization are going to be provided by vendors, it is possible to determine the cost of the entire project or its components by comparing suppliers’ pricing bids or proposals. They can be collected in a structured way by using the request for proposal (RFP) document outlining project details, including the service or product to be delivered by a vendor, as well as its quality requirements. After qualified suppliers return the filled RFPs, managers should analyze them to identify a possible project cost range and decide on final estimates.

Pro: Vendor bid analysis implies the utilization of data provided by competent specialists. Due to this, the technique is beneficial in situations when managers lack experience in running similar projects. A side advantage of the method is that it helps make more informed procurement and vendor selection decisions, considering both the cost and quality issues.

Con: This project cost estimation technique is not exhaustive, especially if only a portion of project realization activities rely on suppliers’ contributions. Besides, it doesn’t take into account administrative expenses and other indirect costs that still play an essential role in working on the project.

5. Top-down Estimation (Class 5)

Top-down project cost estimation starts with the identification of the overall scope of the project and its total cost. After that, the general cost is broken down into smaller components, depending on the project’s contents and attributes.

Pro: The top-down approach is perfect for preliminary cost estimation performed at the early stages of the project’s life cycle when managers still don’t have a detailed understanding of project features and activities involved. Since this technique doesn’t consider any nuances, it is very easy and fast to implement.

Con: Results of top-down project cost estimation are usually generalized in nature and lack accuracy. Therefore, it is recommended to combine this method with more advanced techniques throughout the course of budgeting and project planning.

6. Bottom-up Estimation (Class 3-1)

In contrast to top-down estimation, the bottom-up approach starts the cost calculation process with the identification and evaluation of separate project components. The expenditures for every individual project task or a series of tasks are then summed up to arrive at the total project cost.

Pro: The bottom-up estimation technique can be very accurate in case a thorough and complete work breakdown structure is applied.

Con: The development of a work breakdown structure is usually time-consuming and requires much effort, especially if the project under consideration is a complex one.

7. Parametric Estimation (Class 5-3)

By using parametric estimation, the total project cost is calculated based on the number and price of the project’s sub-components, also known as work units. The project cost estimation process includes just 3 core steps:

- Identify relevant project units (i.e., number of peanut butter jars to be produced, square feet of pavement to be laid, lecture hours to be delivered, etc.);

- Estimate the cost of every unit by summing up the price of materials, labor, etc.;

- Use the following equation to form the overall picture of project expenses:

Number of Work Units × Cost of a Single Unit

To define the cost of a single unit before administering the project, you may refer to historical data taken from previous projects or industry examples.

Pro: Parametric estimation allows obtaining very accurate cost forecasts in case the calculated single unit costs are correct and realistic.

Con: The method is suitable only for projects characterized by a high degree of task repeatability and cannot be applied to creative ones.

8. 3-point Estimation (Class 3-1)

To calculate a probable project cost with the 3-point estimating technique, one needs to create 3 types of estimates:

- An optimistic estimate – the amount of money your team hopes to spend on project activities,

- A pessimistic estimate – the project’s cost in the worst-case scenario when many things don’t go as expected,

- The best-guess estimate – a realistic figure, the amount of money the team will most likely spend on project activities.

The final project cost value is then calculated by using the following equation, also known as the PERT formula:

[Optimistic Estimate + Pessimistic Estimate + (4 × Best-guess Estimate)] / 6

Pro: 3-point estimation is more detailed than the majority of single-point estimation techniques and can be very accurate if a thorough work unit analysis is carried out. One of its major benefits is that it takes into account project risks and, thus, provides managers with the information necessary to prevent cost overruns. In this way, it not only increases forecast accuracy but also contributes to a better quality of cost management in general.

Con: 3-point estimation is a time-consuming technique. Besides, it requires know-how and expertise to produce accurate results. It should be carried out by specialists who are perfectly aware of all project attributes and parameters, as well as the situation in the business world and potential environmental changes.

9. Reserve Analysis (Class 5-4)

As a project cost estimation technique, reserve analysis focuses on factors of cost uncertainty and is primarily concerned with avoiding risks that may lead to cost overruns. The purpose of this method is to determine the size of two types of backup sums:

- Contingency reserve – the amount of money allocated for mitigation of various expected project risks (e.g., delays in supply, increased staff turnover, technological holdbacks, etc.).

- Management reserve – the amount of money that could be utilized to tackle the outcomes of unidentified risks.

Pro: Reserve analysis can be viewed as part of both the risk mitigation and the budgeting processes. It enhances the quality of project cost management by preventing cost overruns and, in this way, maximizes opportunities for the overall success of the planned endeavor.

Con: Reserve analysis doesn’t help calculate types of project costs other than costs of risk (i.e., direct, operating, and administrative expenditures, etc.). Therefore, reserve analysis can be applied only as an auxiliary tool and should always be combined with other cost estimation techniques to develop accurate project budgets.

10. Cost of Quality Analysis (Class 5-4)

The purpose of the cost of quality (CoQ) analysis is to figure out how much money is needed to meet the preset project quality standards. The CoQ calculation process comprises the following phases:

- Define project quality requirements and standards;

- Identify the cost of good quality (CoGQ): cost of activities needed to prevent quality failures + costs of quality appraisal activities;

- Identify the cost of poor quality (CoPQ): expenses the project may incur as a result of internal quality failures (e.g., product re-design, waste of time and material resources, etc.) + expenses the project may incur as a result of external quality failures (e.g., customer complaints, shipping errors, and damages, etc.);

- Calculate the total CoQ with this simple formula:

CoGQ + CoPQ

The received CoQ figure is then used to inform fund allocation decisions in a way that minimizes the risk of financial loss and helps sustain the optimal level of product and service quality.

Pro: Like reserve analysis, CoQ estimation is part of the risk management process and plays a vital role in the prevention of cost overruns.

Con: The technique has a unilateral focus. It doesn’t assist in creating estimates for many essential types of project costs and isn’t enough to develop a comprehensive project budget.

Making Sure Your Cost Estimates Are Accurate: Tips + Tricks

1. Clarity is key

Clarifying project requirements is fundamental for accurate cost estimation. Well-defined requirements ensure that all stakeholders have a unified understanding of the project’s scope, which is crucial in identifying necessary resources and potential risks. This clarity minimizes the likelihood of unexpected changes and scope creep, which can significantly affect project costs.

By having a clear picture from the outset, you can more precisely forecast your finances, optimizing project planning and budgeting.

2. The smaller, the better

Breaking down projects into smaller tasks, a process known as work breakdown structure (WBS), is fundamental for improving the accuracy of cost estimates. This methodical deconstruction allows project managers to analyze each task individually, considering the specific resources, time, and labor required.

By focusing on smaller components, you can arrive at more precise cost predictions because you can account for nuances and variables that might be overlooked in a broad analysis. This granularity facilitates a bottom-up cost estimation approach, leading to a comprehensive and accurate overall project budget.

3. Risks are lurking all around

Risk analysis during cost estimation helps to account for potential uncertainties and unforeseen events. It bridges the gap between initial estimates and actual outcomes and calls for allocating resources for contingencies, thus mitigating the impact of cost overruns.

Such a proactive approach enables project managers to devise more informed, realistic budgets that can absorb and adapt to challenges without compromising the project’s financial viability.

4. Your team members have insight

Seeking input from team members allows you to leverage the diverse expertise and experience within the group. Each member may offer unique insights into potential costs that might otherwise be overlooked, which ensures a more comprehensive assessment. Moreover, collaborative discussions can help identify cost-saving opportunities and provide a platform for vetting assumptions and risk factors.

This team-based approach not only promotes ownership and accountability across the project team but also contributes to a more precise and realistic cost estimation that reflects the combined knowledge of the professionals involved.

5. Vendors can be your cost estimation mates

Securing quotes from vendors is a critical step in ensuring the accuracy of cost estimates for projects. The process involves collecting detailed pricing information directly from suppliers for the specific goods and services needed for a project. It helps to ensure that cost projections are based on actual market rates rather than theoretical figures or outdated data, leading to more precise budgeting and fewer financial surprises during project execution.

6. Milestones call for action

Re-estimating costs at project milestones allows you to incorporate real-time data and experiences gained during project execution into the estimation process. By assessing current spending against the budget and considering any changes in scope, resource availability, or external factors such as market fluctuations, cost estimates can be recalibrated to reflect the most up-to-date information.

This ongoing process serves to reduce uncertainties and provides stakeholders with a more precise financial outlook as the project progresses.

7. Historical data is your friend

Utilizing historical data provides insights into the actual costs and resource utilization of past projects. This empirical evidence forms a reliable basis for forecasting, allowing for more precise budgeting and diminishing the likelihood of unforeseen expenditures. By analyzing trends and variances in historical financial performance, estimators can identify patterns, refine cost drivers, and more effectively anticipate potential challenges.

Pro tip:

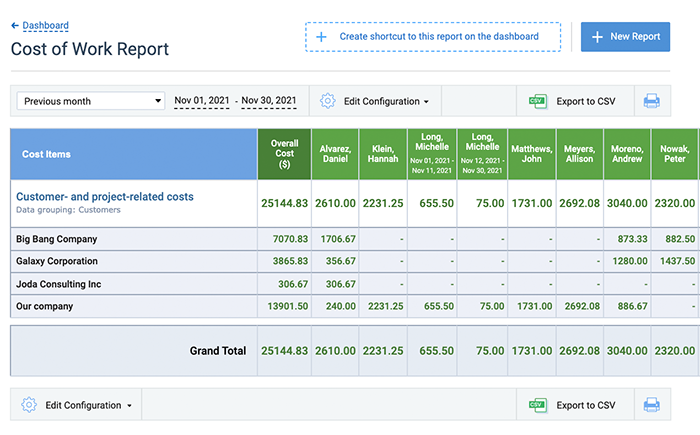

Accessing reliable historical data on project performance is easy with actiTIME. This multifunctional time tracker allows you to get a precise record of hours spent on each task and project. On top of that, it lets you set individual pay rates for each employee. The software will then automatically calculate all staff-related costs by multiplying the recorded time with these pay rates – this automation minimizes human error and provides a reliable foundation for financial planning.

Furthermore, actiTIME features money reports that offer an in-depth analysis of your labor costs, enabling you to create more accurate budgets for future projects.

Sign up for a free actiTIME trial here 👈

Ready to Try Any Project Cost Estimation Techniques?

As you can see, the 10 techniques reviewed in this article produce cost estimates of different accuracy levels. However, if a project cost estimation method is associated with only vague and imprecise calculations, it doesn’t mean it should be discarded right away.

Even inaccurate cost estimates are useful when you’re still planning your project. Besides, approaches used for their creation are usually easy to implement. Thus, lower-class estimation techniques will readily support you in the evaluation of multiple cost variants and scenarios. With their help, you can generate and assess new ideas, perfecting the overall strategic and tactical picture of your future project and gathering all the information needed to arrive at more accurate forecasts at later stages in the project development process.