Time and money are the two main factors of success for any business. Inaccuracy that can be negligible for a freelancer turns out into significant losses for a large team, so setting up an efficient cost tracking process is essential.

Keeping your time and billing records together provides you with accurate reports and streamlines your accounting. You always can generate detailed invoices for your clients and keep track of projects profitability.

Today, we’ll explain how to set up cost tracking in actiTIME – and save your time and efforts.

1. Track Staff-Related Expenses

No matter what kind of employees work in your team – hourly or salaried – you can track and calculate their wages with actiTIME in a streamlined way:

- Set the individual cost of work rates, overtime rates, and time off rates for every worker.

- Then, actiTIME will calculate their wages automatically based on the number of hours tracked.

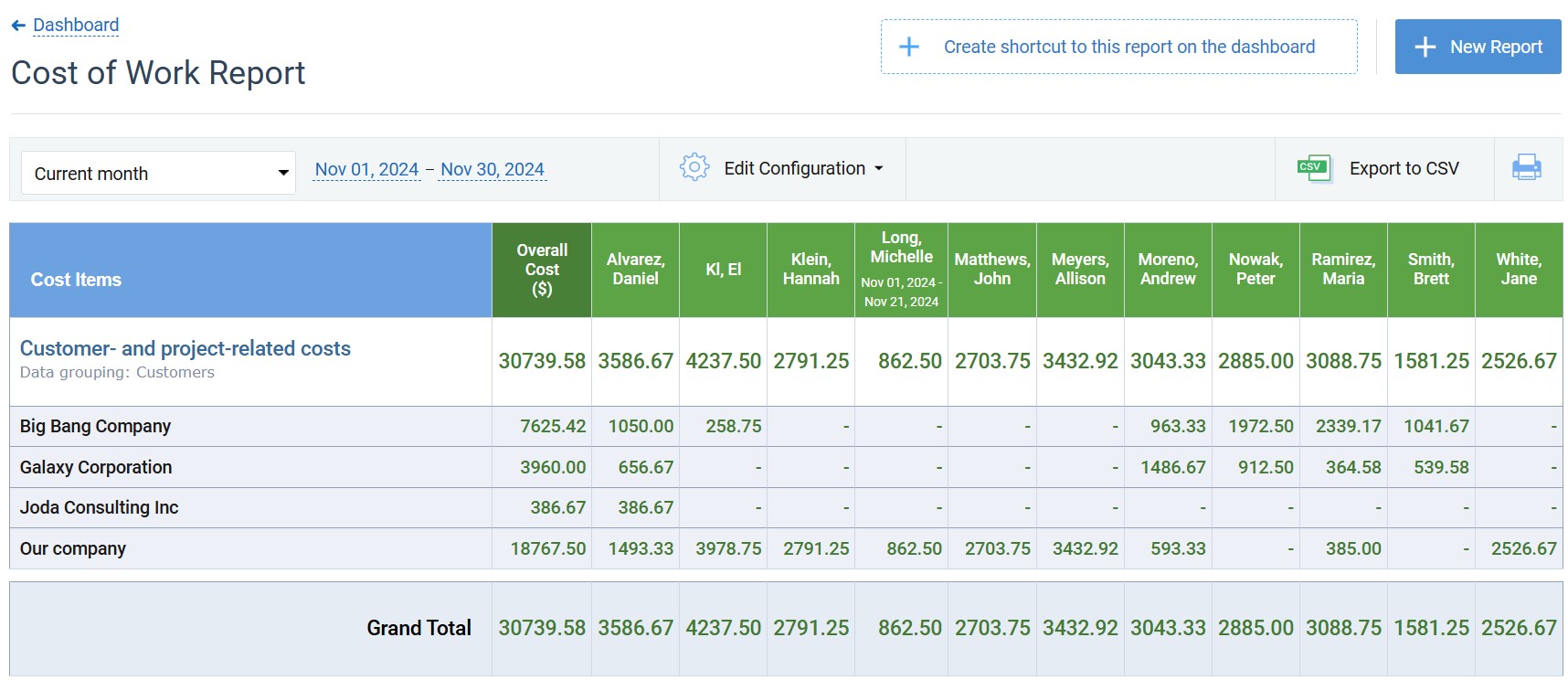

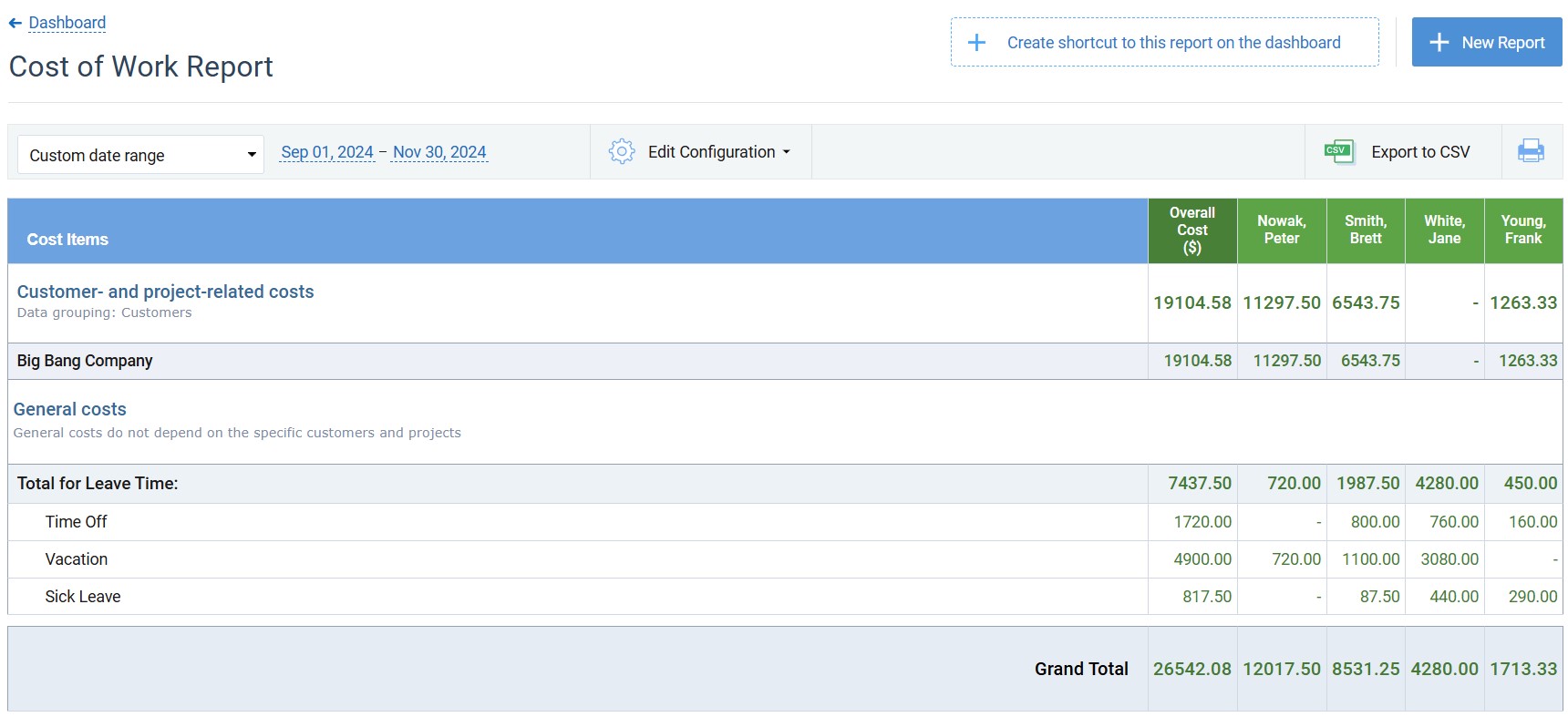

- Once employee timesheets are filled and the time for payroll has come, you can simply run the Cost of Work Report and see how much money you need to pay to every team member and how many staff-related costs your business has incurred over a selected period.

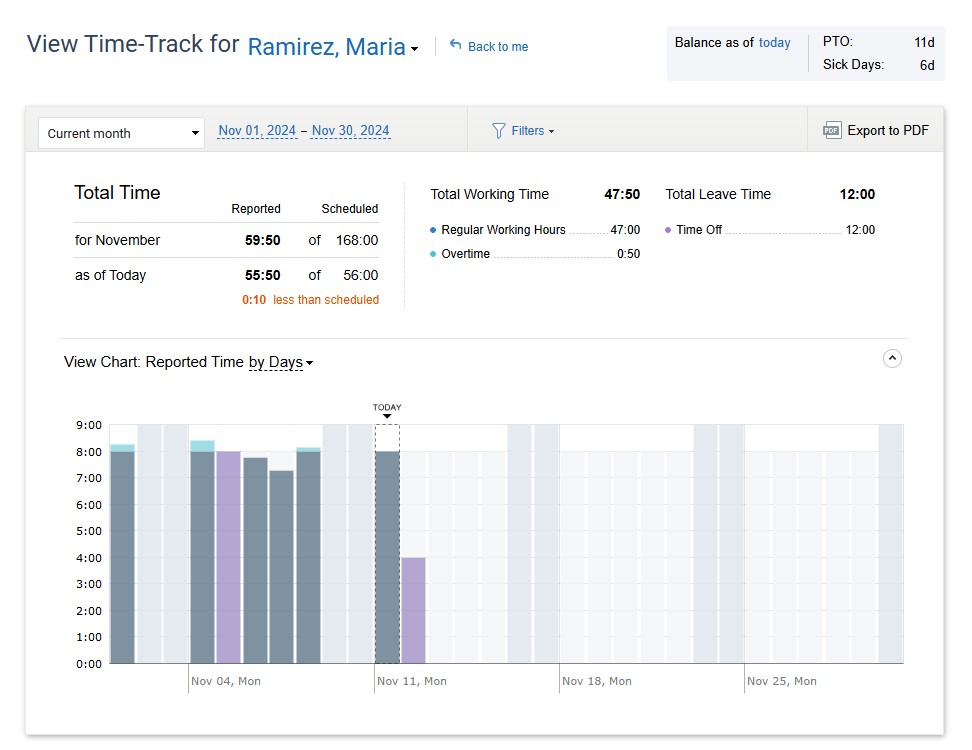

For your salaried staff, use the Time Balance and Overtime Report to track the work time they’re actually spending and compare it to scheduled hours. You can use and see their work time balances in their View Time-Track charts:

2. Set Up Billing Calculations

Cost management isn’t complete without the data on project revenues. Hence, you need to track your billable tasks just as accurately as work-related costs.

With actiTIME, doing so is as easy as pie. It automatically calculates how much money your customers owe you for the completed work:

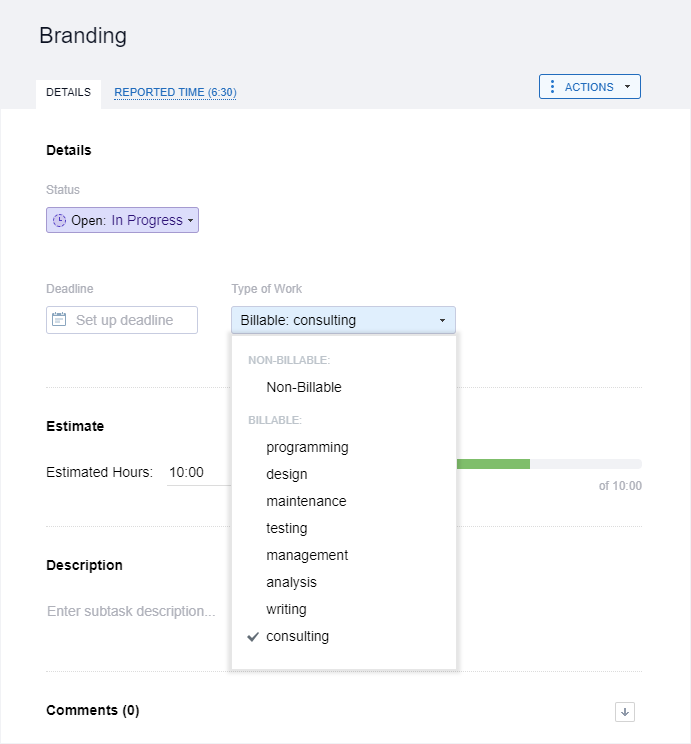

- First, set up billing rates (aka types of work) for specific activities that your employees perform.

- Then, associate them with tasks, and actiTIME will automatically calculate amounts billable to your customers for work performed for them.

- To bill customers, you can also use the built-in invoicing tool to issue invoices with accumulated amounts directly in actiTIME.

Often, there are non-billable activities in the workflow. This applies to internal works, routine tasks, and not customer- or project-specific activities.

You can set up both billable and non-billable types of work, and track time to tasks associated with them – this will help avoid complicated calculations.

3. Allocate and Track Project Budgets

Budgeting is an essential component of project planning. It helps to better control your finances and avoid significant cost overruns.

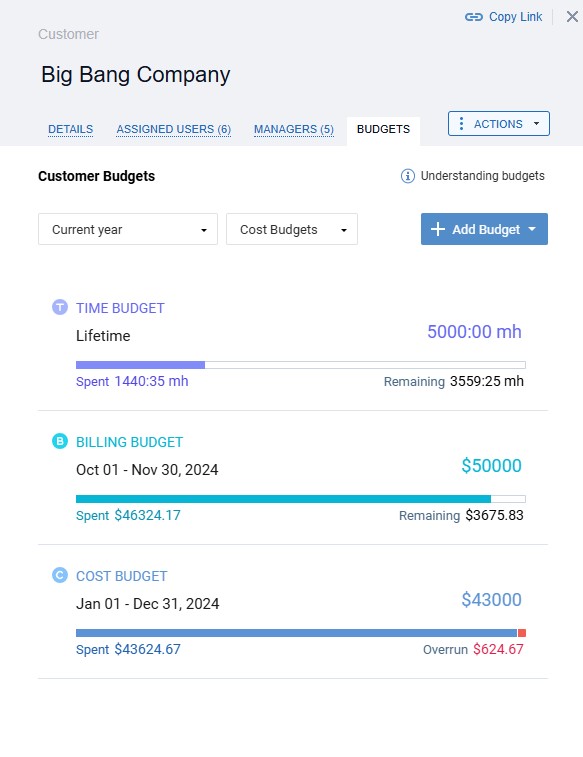

While costs should always be the major item in any budget, it’s useful to take into account other resources as well. That’s why actiTIME allows you to budget not only for project expenses but for billable amounts and time as well. Besides, you can set up those budgets at multiple levels at once: entire customers and projects or tiny task.

- Decide what kind of budget you want to create and choose a customer, project or task to allocate it to.

- Enter the budget amount and set the budget period.

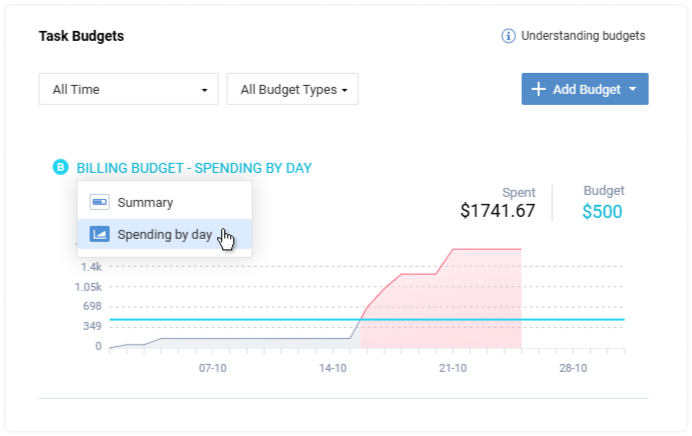

After that, you can track working hours and monitor the use of resources via a visual progress bar – once a budget overrun occurs, the portion of the progress bar will turn red.

To analyze your budget data in greater depth, use this shortcut to open a detailed report:

Find out more about budget management with actiTIME in this post.

4. Review Project Profitability Regularly

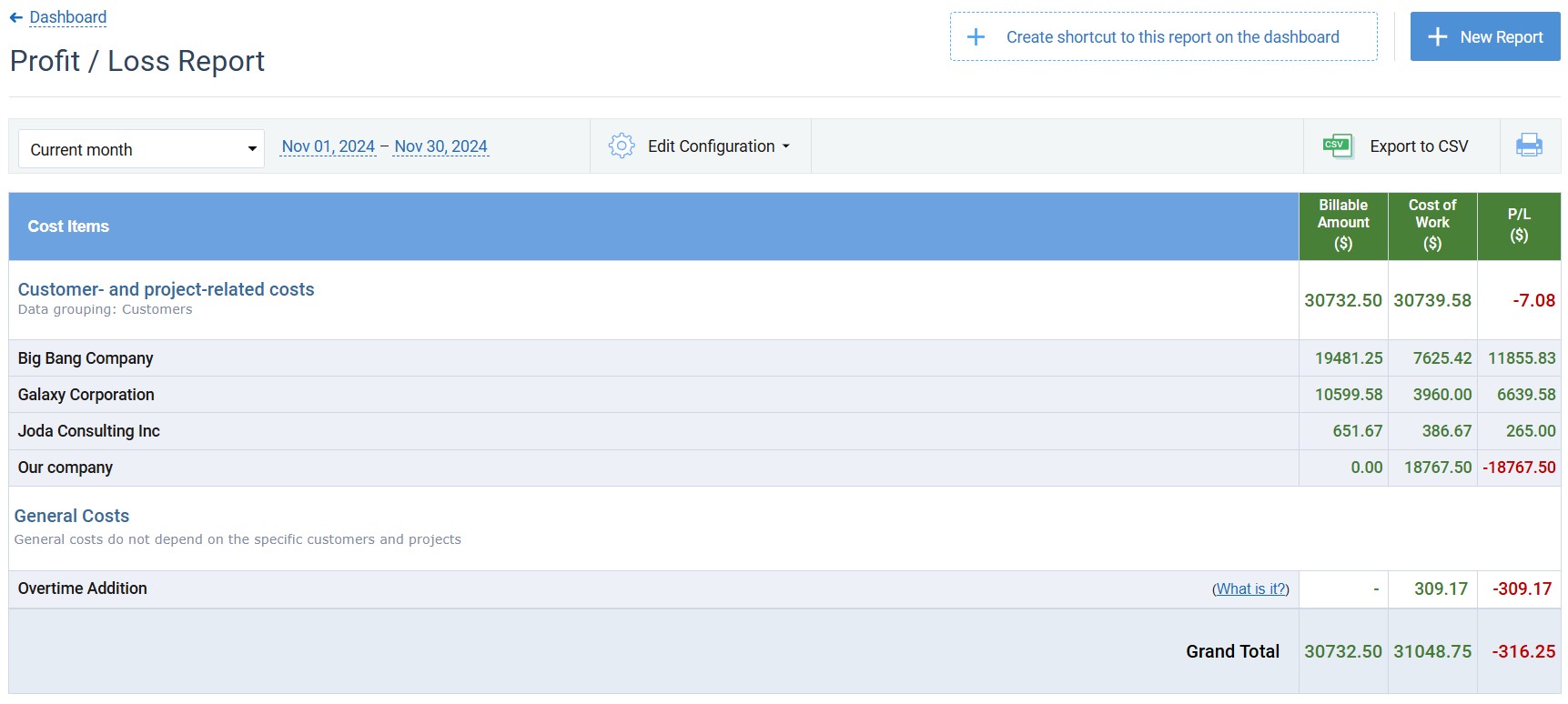

To understand how profitable your project is, you need to compare your billable amounts to costs of work, and it’s easy to do so by running the Profit / Loss Report in actiTIME.

This report presents the data on revenues and expenses related to specific customers, projects or tasks. Besides, it lets you perform a detailed analysis of your project profitability by including employees’ overtime and leave time data into the picture.

This report helps figure out inefficient activities and parts of work, reveal the most expensive parts and see where there’s room for improvement and optimization.

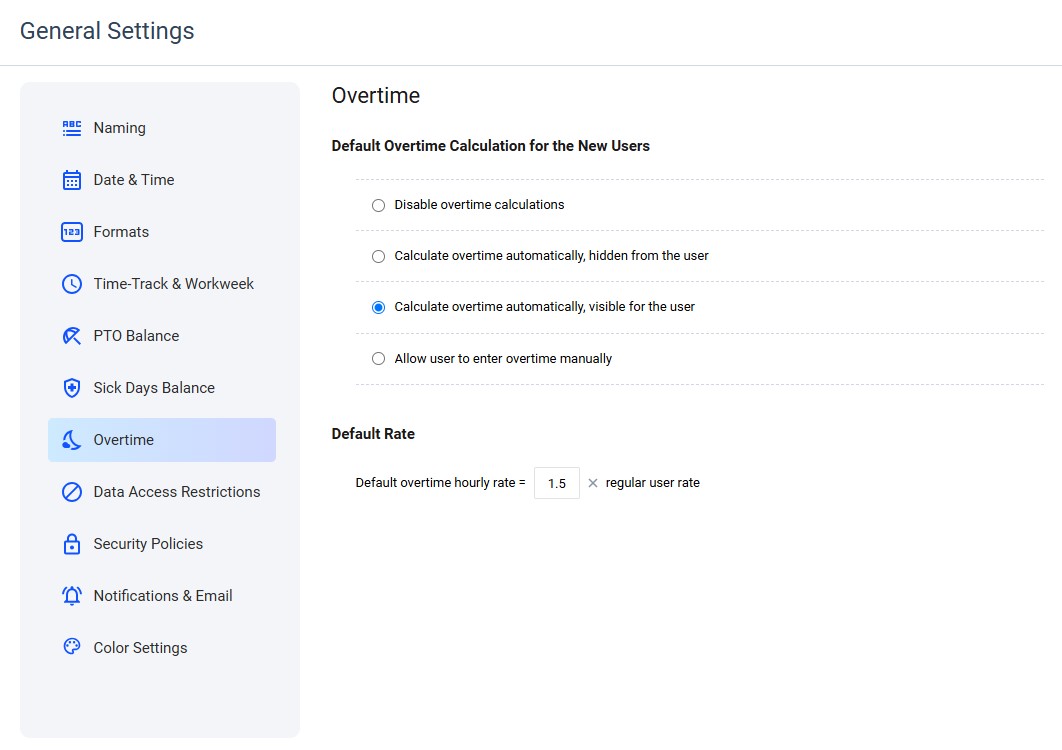

5. Automate Overtime Accounting

Overtime is paid at a different rate. Hence, overtime work is always more costly than regular employee hours.

To minimize overtime-related expenses and track them effortless, you can set up overtime rates for employees in your actiTIME account and select the way overtime should be recorded: manually or automatically.

Overtime cost of work can be set in users’ profiles, and overtime addition is reflected in the Cost of Work Report.

For those who are not entitled to overtime payments, you can disable overtime calculation. In that case, all their work time entries will be calculated as regular time.

6. Track Absence Costs

Just like overtime, employee absences can place an extra financial burden on your business and, if untracked, leave-related costs can quickly spiral out of control.

Thus, use actiTIME to set different hourly pay rates per leave type and automatically calculate the costs associated with vacation, sick leave, and personal time off separately. This will save your accountants’ time and make it easy to see which leave type is the most costly for your business via the Cost of Work Report (just don’t forget to include your leave costs into the picture when configuring it):

Summary

In order to be effective, your cost tracking process must be comprehensive. So, don’t limit it to tracking merely your project expenses!

Make sure to track your billable and non-billable time + analyze costs against revenues to understand how financially healthy your business is and find a way to become more cost-efficient.

In the end, managing costs together with timesheet records gives a very accurate picture of how you utilize business resources and facilitates accounting work.

Using actiTIME’s numerous progress tracking tools, budget management functionality, and custom reports, you are sure on the way to streamline your work processes, tame project costs, and increase profitability. So, give it a try!