In the era of the gig economy, many professionals choose the path of self-employment. Today, freelancing is no longer limited to creative work: virtually everyone can benefit from its flexibility and autonomy. Accountants are also a part of this trend, as the increasing number of accounting professionals become sole traders.

Freelancing is difficult but rewarding. Compared to office jobs, it has multiple benefits and downsides. Being your own boss means working as much as you need and like, defining and readjusting your work and rest schedules ad hoc, and turning down work you don’t want to do. While being a great alternative to nine-to-five work, this also creates challenges so big that many prefer to stay in the office.

Among the challenges that freelancing accountants face, the following are the most detrimental for work process and results:

- Drawing the line between work time and personal time.

- Dealing with inconsistent income.

- Struggling with procrastination and distractions.

- Having to constantly market yourself.

The effects of these downsides can be mostly handled by building an efficient work management process. Let’s see what you can do as a freelancing professional, and how you can organize your work to overcome the challenges of freelance employment.

Automate as much as possible

Using the benefits of technology means reducing effort spent on your work, speeding it up, and eliminating the errors of manual data processing. Adopting tools that automate your work is an important step of establishing your work processes, so it’s worth spending some time and effort on trialing various solutions and find those that meet your needs.

Many freelancing accountants prefer using cloud billing & accounting solutions (such as QuickBooks Online Accountant) for running their practice. This allows to securely store the data in one place, eliminate technical works, and access the data from anywhere.

Another important aspect of automating work processes is implementing a smart work management tool. It will allow you to keep track of your daily, weekly, monthly etc. scope of work, meet deadlines, and better plan workloads for future.

Prioritize your activities

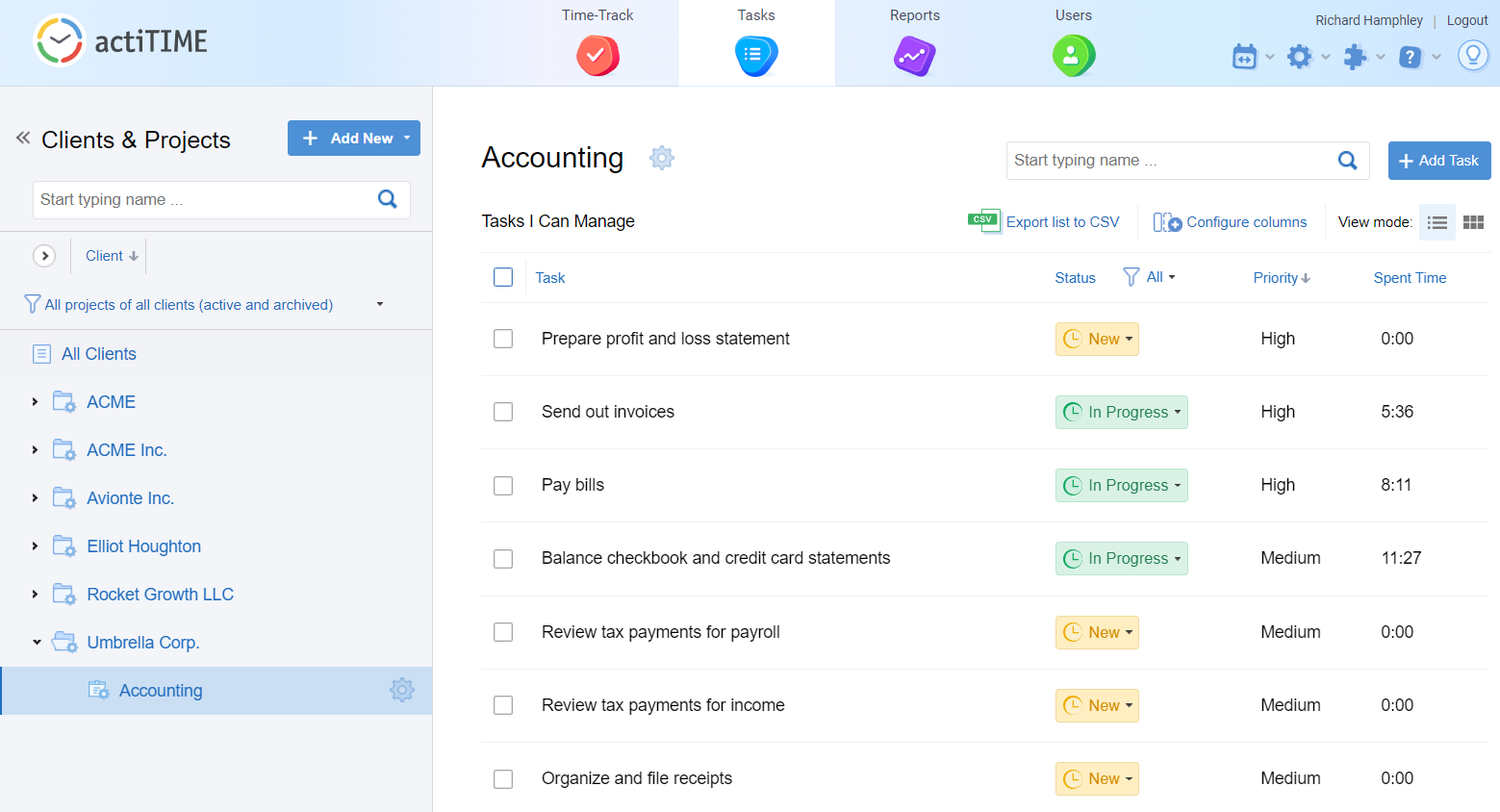

As a freelance accountant, you have a million and one things to do for different clients. To manage them effectively and on time, you need to have a prioritized task list where you can review high-priority items, add them to your weekly timesheet and change their status and priority in a few clicks.

So, consider using a time tracking system with solid task management functionality. For example, in actiTIME, you can create multiple clients, project and tasks, build as many custom statuses and parameters as you see fit. For example, you can create a custom parameter named Priority with any number of value names, e.g. High, Medium and Low. Assign these values to tasks to sort your task list and report data.

Account for all your billable time

Being your own boss often involves omitting accountability for work time. Why keep a record of it when no one is chasing you for timesheets? However, that’s the main reason why many freelancers get underpaid. They usually don’t count exact amounts of time spent for their clients’ work assignments, and, preferring to err on the safe side, under-bill their customers.

In most cases, this approach entails significant losses in revenue. What’s more, this way it’s hard to understand how productive you are. So using a timekeeping tool is a must for a successful solo entrepreneur’s career.

As the experience of many freelancers shows, keeping both time and billing rates in one place is a really efficient approach. When selecting a time-tracking software solution for your practice, make sure that the tool of your choice supports calculation of billable amounts.

Ideally, the tool should also allow running reports that provide you with a clear picture of profitability of your work. Understanding profitability opens many ways to optimize work and increase revenue. Such solutions as actiTIME allow to get a big picture of your expenses and revenue, and delve into details to see where there’s room for improving processes.

Build processes and routines

Starting a freelance career means creating work processes and routines from scratch. Skipping this step involves increased manual work in the course of future work, which is frustrating and negatively affects productivity. That’s why those who spend some effort on building up processes in the beginning succeed in the future.

Many work tasks and activities are repetitive, so why not automate and optimize them? Develop a process that would include such tasks as invoicing, payroll processing (if you have employees), communication with clients, etc., and review them to see how they can be optimized.

Invest in strategic activities

For most freelance accountants, marketing themselves is one of the biggest challenges. Being non-marketers by their nature, they struggle with finding clients and expanding their clientele. It’s good if you have some contacts from your previous work, but anyway, you need to work on getting new clients and retaining existing ones.

Building your digital presence and developing your personal brand seems to be fresh ground that requires tons of effort, but it is less difficult than it looks. You can start with building your audience on social media and asking existing customers for feedback and reviews, and extend your promotional activities with ad campaigns, a blog or a professional website, and advanced social media marketing.

Don’t mix work and personal time

It’s a trap that any freelancer falls into at some point: there’s no eight-hour workday or forty-hour work week, so work activities invade personal time. The results tend to be dismal for future success: fatigue, productivity decrease, cynicism in work and communication, and eventually burnout. Another side of not separating work from leisure time is procrastinating on the Internet throughout the entire day, which jeopardizes deadlines and undermines reputation and career.

To avoid this, take preventive measures in advance. A good way to separate work from rest is creating a schedule and following it. Plan time for non-work-related activities, set availability hours and let your clients know them, and explain to your friends and family that you’re not available for grocery shopping, household activities, babysitting etc. during your work hours.

Summary

Freelancing sets new challenges to accounting professionals who decide to leave office work and start a solo career. Handling them is easier with special solutions that help structure activities, organize and automate workflow, and keep track of how you’re spending your time. Use them to create an efficient work process, define and plan workloads, and create a successful career.