Even though many US companies are eligible for the R&D tax credit, they never take advantage of it. The reasons can be multiple: either they aren’t really aware of this possibility, not sure whether their organization qualifies, or simply don’t bother to apply. As a result, they might be missing out on hundreds of thousands of dollars.

So, what exactly is the R&D tax credit?

Let’s find out!

R&D Tax Credit: Overview

Research & Development (R&D) Tax Credit is a tax incentive introduced by the US Government to foster innovation. It started out as a temporary program in 1981 and remained that way until December 2015, when the PATH Act made the R&D Tax Credit permanent.

It allows companies to claim around 6-8% (or more) of their eligible R&D expenses. This percentage may vary from state to state.

Who Is Eligible?

People often think that only research labs or large corporations qualify for this credit, but this isn’t exactly true. Businesses of all sizes may apply if they carry out research or experimental development in the following industries and spheres of activity:

- Agriculture

- Food and beverage

- Manufacturing

- Software engineering

- Brewery and winery

- Machinery and automobiles

- Industrial chemistry

- Foundry

- Architecture, etc.

Among other misconceptions is the idea that you have to introduce a breakthrough technology to qualify, or at least be successful in your research. Well, neither is actually true.

It doesn’t really matter if your research fails, or results in only minor improvements. It is the effort that gets rewarded provided that you can present evidence to support your R&D activities.

What Expenses Can Be Claimed

According to the US IRS agency, companies can claim credit for nearly all expenditures related to the development or optimization of a product. More specifically, they include:

- Wages paid to the employees who conducted the R&D activities;

- Supply and material costs related to the R&D, including prototype models;

- Contract costs – if a third-party contractor was hired to conduct research for your company;

- Computer leasing – if you have used cloud services to perform research or experiments.

InterTalk Critical Information Systems – a Canadian high-tech company specializing in systems engineering and integration – built an efficient time tracking process that helped them to take advantage of the R&D tax incentive program.

What Activities Qualify

For a business to qualify for the R&D tax credit, its activity must satisfy the criteria listed below.

- Seek to discover new information and eliminate technical uncertainty. In other words, the research should reveal new knowledge about product development or improvement. For example, QA activities or market research will not qualify here.

- Involve experiments.

- Be technological in nature and based on the hard sciences (from physics and chemistry to engineering and computer science).

- Have a qualified purpose, such as creating or improving an existing product or process.

How to Get Your R&D Tax Credit

As already mentioned, the most important – and challenging! – part is to support your claim with evidence. Sure enough, you will need to have your costs and projects documented. There is no official guidance on the required documentation, but you should do your best to provide accurate, structured, and specific information.

By the way, it’s also possible to apply for an R&D tax credit retroactively for at least three past years, so make sure to document everything along the way.

Here are more tips on how to prepare documentation for a tax return:

- Collect records to demonstrate your R&D activities (preferably at the time when they are carried out). This documentation might include lab reports, patent claims, experiment descriptions, protocols, logs, etc. Relevant internal emails could also be useful here.

- Implement an online timesheet to facilitate project time tracking. Since wages constitute the largest part of most tax claims, it would be a good idea to pay extra attention to this type of documentation. Standard payrolls is not enough: you will need to demonstrate how your labor costs are connected to the R&D activities. That’s where a detailed breakdown of working hours by project could come in really handy.

- Keep your contract agreements. If you appoint subcontractors to perform the R&D for you, contract papers will be necessary to acknowledge your rights to the intellectual property. Other good examples of supporting documentation are invoices and 1099 forms.

- Structure your general ledger so that you can easily find supply costs associated with the R&D. Ideally, this information should be backed up by relevant invoices.

While there is no explicit guidance on how much documentation is enough, you should focus on providing quality rather than excessive information. According to the IRS, records should be presented in usable form and sufficient detail.

Pro tip:

When it comes to tracking employee costs incurred during R&D projects, actiTIME provides an efficient and comprehensive solution. With its help, you can accurately monitor resources and rest assured every hour and expense is logged for potential tax credits.

Here’s how it works:

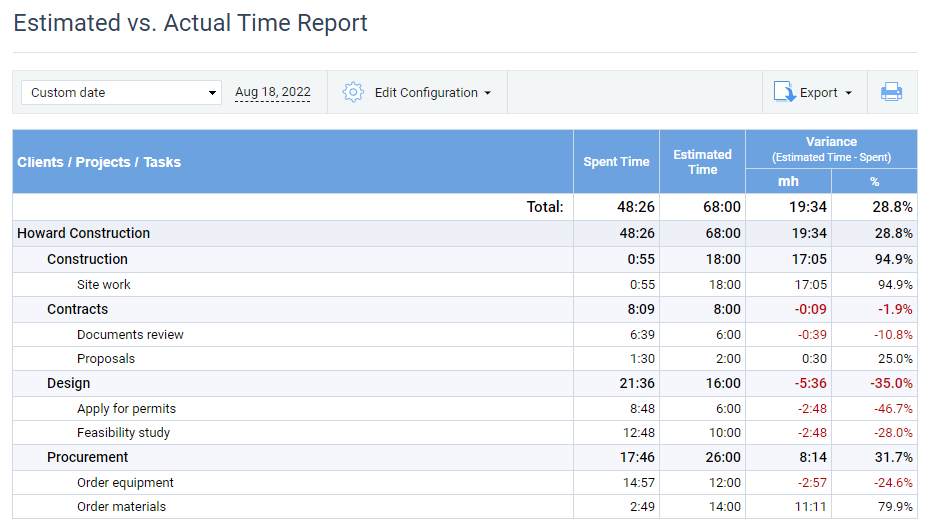

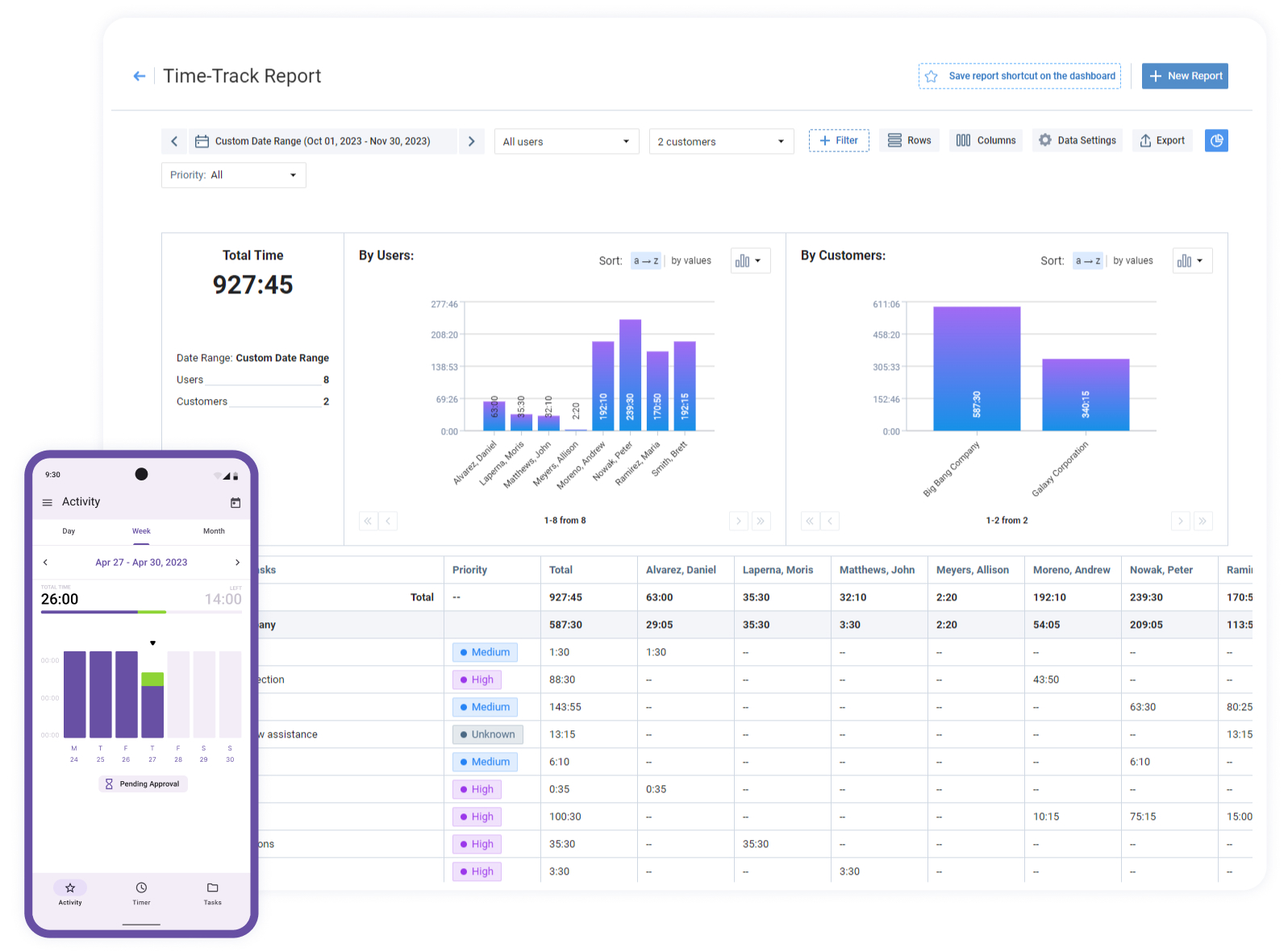

- Detailed time tracking. Your employees can log time spent on work with precision and using a variety of methods (from manual-entry timesheets to a fully automated browser extension). This feature makes it easy to capture every hourly cost of your R&D activities and justify expenses for tax credit applications.

- Customizable reporting. actiTIME lets you generate detailed reports tailored to your specific needs. For instance, you can break down expenses by project, activity, or team to get clear insights into how your resources are being utilized and then enhance decision-making.

- Project budgeting. You can also monitor budgets for R&D projects in real time. Set task estimates and automated notifications on budget overruns to get promptly alerted when your performance costs approach the agreed budget limits and take proactive measures to dodge a disaster.

- Invoice generation. actiTIME allows you to quickly create invoices for billable hours and export them as PDFs. Use it to maintain steady cash flows while keeping financial records transparent and organized.

Simplify the administrative burden of applying for the R&D tax credit – sign up for a free actiTIME trial here.

What Further Steps You Need to Take

Companies who want to claim R&D tax credit have to submit their applications to the IRS (Internal Revenue Service). Apart from supporting documentation, you need to provide Form 6765 (as well as Form 3800 for small businesses and several other categories of taxpayers).

During the audit, the IRS might conduct interviews with technical or financial staff to clarify certain questions. Many businesses prefer to appoint a tax advisor to guide them through the application process.

Besides, most US states offer their own R&D tax incentives. Since state requirements might be different from the federal ones, it makes sense to clarify them with the local tax authorities.

R&D Tax Credit by State

Here’s a comprehensive list of states with their own R&D tax credit regulations (source):

- Alaska. Credit rate of 18%, nonrefundable.

- Arizona. Credit rate of 15-24%, partially refundable.

- Arkansas. Credit rate of 20-33%, nonrefundable.

- California. Credit rate of 15%, nonrefundable.

- Colorado. Credit rate of 3%, nonrefundable.

- Connecticut. Credit rate of 2-20%, partially refundable.

- Delaware. Credit rate of 10-20%, refundable.

- Florida. Credit rate of 10%, nonrefundable.

- Georgia. Credit rate of 10%, nonrefundable.

- Hawaii. Pro-rata credit rate, refundable.

- Idaho. Credit rate of 5%, nonrefundable.

- Illinois. Credit rate of 6.5%, nonrefundable.

- Indiana. Credit rate of 10-15%, nonrefundable.

- Iowa. Credit rate of 4.5%-6.5%, refundable.

- Kansas. Credit rate of 6.5%, nonrefundable.

- Louisiana. Credit rate of 5-30%, nonrefundable.

- Maine. Credit rate of 7.5%, nonrefundable.

- Maryland. Credit rate of 10%, partially refundable.

- Massachusetts. Credit rate of 7.5-10%, nonrefundable.

- Minnesota. Credit rate of 4-10%, nonrefundable.

- Missouri. Credit rate of 15%-20%, refundable.

- Nebraska. Credit rate of 15%, refundable.

- New Hampshire. Credit rate of 10%, nonrefundable.

- New Jersey. Credit rate of 10%, partially refundable.

- New Mexico. Credit rate of 5-10%, partially refundable.

- New York. Credit rate of 3-20%, refundable.

- North Dakota. Credit rate of 8-25%, partially refundable.

- Ohio. Credit rate of 7%, nonrefundable.

- Pennsylvania. Credit rate of 10-20%, refundable.

- Rhode Island. Credit rate of 16.9-22.5%, nonrefundable.

- South Carolina. Credit rate of 5%, nonrefundable.

- Texas. Credit rate of 5%, nonrefundable.

- Utah. Credit rate of 5-7.5%%, nonrefundable.

- Vermont. Credit rate of 27%, nonrefundable.

- Virginia. Credit rate of 10%, partially refundable.

- Wisconsin. Credit rate of 5.75%, partially refundable.

R&D Tax Relief in the UK

On the other side of the world, businesses also have an opportunity to get reimbursement for their R&D activities at a rate of 11-20%.

Naturally, the UK regulations are slightly different from the ones in the US. Here’s a brief summary of the major points (source):

- You are eligible for the R&D tax relief only if you work on innovative projects that have a purpose to make an advance in the spheres of science or technology (R&D projects in humanities, social sciences, and arts are not eligible for tax relief).

- The projects you’re working on must be in line with your company’s overall activities (i.e., if you’re a software developer, you cannot claim a tax relief for an advance in chemistry).

- Your project should strive to overcome a particular technological or scientific uncertainty (i.e., something you or other experts in the field can’t regard as feasible or impossible with certainty since there’s no sufficient proof).

- Costs that qualify for expenditure credit include consumable items (e.g., materials, power, etc.), cloud computing, software, externally provided workers, and regular staff-related expenses (e.g., salaries, bonuses, etc.).

Summary

If a company conducts experiments or tests while developing a product or improving services, its activities might qualify as R&D under the US federal tax incentive. This opens up an attractive opportunity to claim a part of your research expenses and use it to fuel future projects.

Just keep in mind the most important part of the process – collecting the supporting documentation: lab reports, invoices, payrolls, and, of course, employee timesheets.

With actiTIME, timesheet management becomes a breeze.

This multifunctional project management solution helps to collect highly accurate time tracking data to simplify the process of claiming your tax credits and maximize your financial benefits. Moreover, it can boost your team members’ performance and productivity, allowing them to take research and innovation to a whole new level.

Give actiTIME a try to power up your R&D projects and achieve truly amazing results.